Vestas expands turbine market share to 22%; US developers secure 6.6 GW at 60% PTC

Our pick of the latest wind power news you need to know.

Related Articles

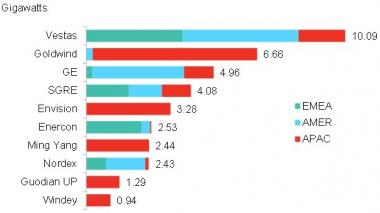

Vestas raises its share of global turbine market to 22%

Denmark's Vestas installed 10.1 GW of onshore wind capacity in 2018, increasing its share of the global turbine market from 16% to 22%, BloombergNEF (BNEF) said in a report published February 14.

Total annual global wind installations fell by 3% to 45.4 GW and the top four companies supplied 57% of the global turbine market, BNEF said.

China's Goldwind installed 6.7 GW of turbines last year-- mostly in China-- to become the second largest turbine supplier by capacity.

GE supplied 5.0 GW of turbines while Siemens Gamesa installed 4.1 GW, some 40% lower than in 2017. As a result, Siemens, slipped from second largest supplier in 2017, to fourth.

Top 10 onshore wind turbine suppliers in 2018

(Click image to enlarge)

In the U.S., GE and Vestas both installed around 3 GW of capacity in 2018.

According to BNEF, Vestas led GE by 44 MW. Last month, the American Wind Energy Association said GE was slightly ahead in 2018, installing 40% of turbine capacity compared with 38% for Vestas.

US wind developers purchase 6.6 GW equipment at 60% tax credit

U.S. wind developers purchased sufficient equipment in 2018 to qualify 6.6 GW of new wind capacity for 60% production tax credits (PTCs), Wood Mackenzie Power & Renewables said in a new report February 12.

Since 2016, the U.S. 10-year wind Production Tax Credit (PTC) drops 20% per year. Projects qualify for the credit by making 'safe harbor' investments and the 60% credit for 2018 equates to $13.8/MWh. The projects must be online by 2022.

In 2016 and 2017, developers made purchases to qualify more than 55 GW of wind capacity for the 100% and 80% tax credits available in those years, Wood Mackenzie said.

Despite these large equipment purchases at higher subsidy levels, a "diverse field" of developers invested in 60% safe harbor equipment last year, the consultancy said.

"The relative stability of the U.S. market compared to more volatile international markets, along with the security and ability to monetize 10 years of tax credits continues to attract long-standing investors in the U.S. wind power market, as well as newcomers," it said.

US forecast wind installations by quarter (GW)

(Click image to enlarge)

Source: Wood Mackenzie Power and Renewables, January 2019

Oregon to host US' largest wind-solar-storage plant

Portland General Electric (PGE) and NextEra Energy Resources have agreed to build the US's largest 'hybrid' wind-solar-storage project in Oregon.

The Wheatridge Renewable Energy Facility will include 300 MW of wind capacity, 50 MW of PV solar and 30 MW of battery storage, the companies announced February 13.

The facility will incorporate 120 GE Renewable Energy turbines. The solar plant will be one of the largest in Oregon and the battery plant will be one of the largest in the US.

The wind component of the facility is expected online by December 2020 and will qualify for 100% of the federal production tax credit (PTC). The solar and battery plants are scheduled to be built in 2021 and will qualify for the federal investment tax credit (ITC).

PGE will own 100 MW of the wind project and NextEra Energy Resources will own the balance of the project and sell its output to PGE under 30-year power purchase agreements.

The new facility will increase PGE's contracted wind capacity to over 1 GW.

"We're moving aggressively to integrate smart grid technologies and renewable energy," Maria Pope, PGE president and CEO, said.

"Wheatridge will be a model for integrating renewable generation and storage to cost-effectively reduce emissions while maintaining a reliable grid," Pope said.

NextEra Energy Resources acquired the Wheatridge wind project from Swaggart Wind Power in 2017. NextEra and PGE then expanded the project scope to include solar generation and battery storage.

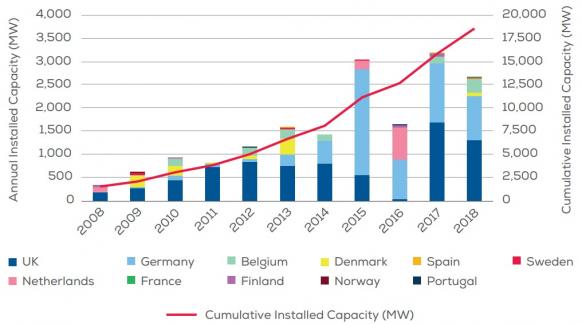

Europe annual offshore installs dip after record 2017

Europe installed 2.7 GW of offshore wind capacity in 2018, some 15.8% lower than the record 3.1 GW installed in 2017, WindEurope said in an annual report.

By the end of 2018, Europe's installed offshore capacity had risen to 18.5 GW.

Developers commissioned 18 offshore wind farms in 2018 and 85% of new capacity was installed in UK or Germany, WindEurope said.

Europe annual offshore wind installs by country

(Click image to enlarge)

Source: WindEurope, February 2019

Siemens Gamesa supplied 62% of offshore wind turbines while 33% were supplied by MHI Vestas. GE Renewable Energy also connected its first offshore wind turbines in Europe at the Merkur wind farm in Germany.

The average capacity of newly-installed turbines was 6.8 MW in 2018, up by 15% year-on-year. MHI Vestas commissioned the largest turbines to date, installing 8.8 MW units at Vattenfall’s European Offshore Wind Deployment Centre (EOWDC) in Scotland.

Investments in new offshore wind projects rose by 37% in 2018 to 10.3 billion euros, WindEurope said.

"Twelve projects reached [final investment decision], totalling 4.2 GW of additional capacity," it said.

New Energy Update