US wind prices hit $20/MWh; Deepwater bids 144 MW offshore wind-battery project

Our pick of the latest wind power news you need to know.

Related Articles

US wind prices drop to $20/MWh to threaten gas plant advantage

The U.S. average long-term offtake price for new wind projects fell to around $20/MWh in 2016, driven by technology advancements and cost reductions, according to a new report by the Department of Energy (DOE) in collaboration with the Lawrence Berkeley National Laboratory.

The sample pool used for the '2016 Wind Technologies Market Report' was dominated by projects situated in the lowest-price regions in central U.S. but recently-signed wind power contracts "compare favorably to projections of the fuel costs of gas-fired generation," the report said. Low wind offtake prices have spurred demand from traditional utilities as well as corporate clients and government institutions, it noted.

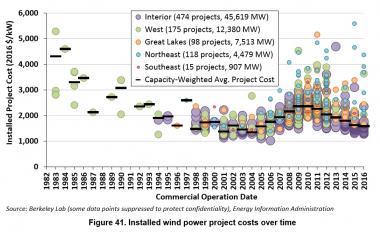

The average installed cost of U.S. wind projects was $1,590/kW in 2016, some 33% lower than costs in 2009-2010, according to the report. Wind turbine equipment prices were in the range of $800–$1,100/kW in 2016, it said.

US installed wind power costs

(Click image to enlarge)

Source: US Energy Information Administration, Berkeley Lab.

The average generating capacity of U.S. wind turbines installed in 2016 was 2.15 MW, some 11% higher than the average over the previous five years, according to the data.

The average rotor diameter was 108 meters, up by 13% from the previous five-year average.

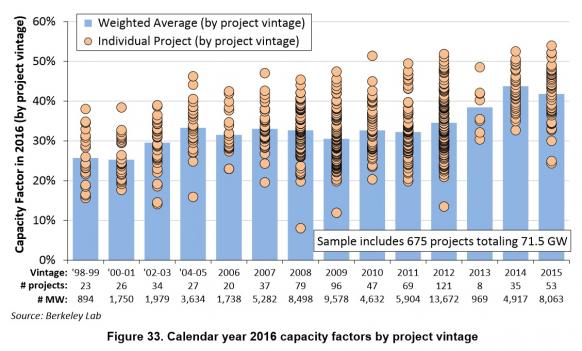

"Moreover, turbines originally designed for lower wind speeds are now regularly deployed in higher wind speed sites, boosting project performance. Increased rotor diameters, in particular, have begun to dramatically increase wind project capacity factors," the report said.

The average capacity factor for projects built in 2014 and 2015 was 42.6% in 2016, it said.

US 2016 capacity factors by project vintage

(Click image to enlarge)

US offshore wind project pipeline estimated at 24.1 GW as costs plummet

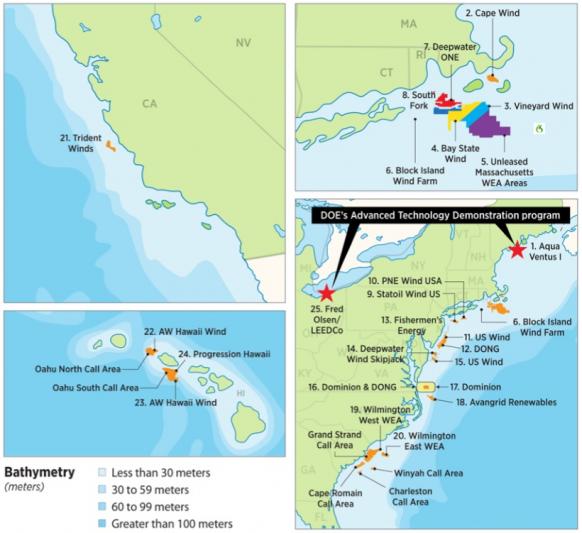

The U.S. offshore wind project pipeline is estimated at 24.1 GW and developers hold exclusive site concessions for 14.8 GW of projects, according to the Department of Energy's 2016 Offshore Wind Technologies Market Report, published this month.

"After years of regulatory planning and leasing, confidence in the nascent U.S. offshore wind market has increased as the result of declining offshore wind costs globally, continued supply chain development, and higher levels of activity in supportive domestic state policy," the report said.

In December 2016, Deepwater Wind commissioned the U.S.' first commercial offshore wind farm off Rhode Island.

The 30 MW Block Island project is comprised of five 6 MW turbines manufactured by General Electric (formerly Alstom Wind Power).

US offshore wind projects

Source: National Renewable Energy Laboratory (NREL).

"U.S. industry activity is accelerating, emboldened not only by the first wind farm off Block Island, but by the assertive presence in the U.S. of well-capitalized and experienced offshore wind developers (e.g., DONG Energy, Statoil ASA, Iberdrola), and the rapid decline in European offshore wind auction strike prices approaching a market competitive range," the DOE said in its report.

Global offshore wind market to double by 2020; China to lead growth

The global offshore wind market will almost double by 2020 to 34 GW and installed capacity in China will surpass the UK in 2022, according to the latest projections from Bloomberg New Energy Finance (BNEF).

BNEF predicts the global offshore wind market will grow at a compound annual growth rate of 19% between 2017-25, reaching a cumulative capacity of 71 GW in 2025.

Global offshore installed capacity forecast

Note: ‘Other’ includes Finland, France, Ireland, Italy, Japan, Korea, Taiwan, U.S., Norway, Portugal, and Sweden. Source: BNEF

European offshore wind turbine companies are seeking routes to China's fast-growing offshore wind market, BNEF analysts said in a statement.

"Dong Energy and Macquarie Group currently own stakes in projects in Taiwan. MHI Vestas Offshore Wind is opening a regional office in Japan. They expect these bases to make the leap into China a little easier," the analysts said.

US' Deepwater Wind proposes world’s largest offshore wind farm with storage

Deepwater Wind plans to build a 144 MW wind farm in Massachusetts waters paired with a 40 MWh Tesla battery storage system, Deepwater Wind announced July 31.

The 'Revolution Wind' project would be situated within Deepwater Wind's lease site off the coast of Massachusetts and completed by 2023. In total, the lease site has the potential to host 2 GW of projects and Deepwater Wind already plans to build the 90 MW South Fork Wind Farm within the site, exporting power to Long Island.

The Revolution Wind project bid is a response to a request for proposals from regional municipalities for low carbon energy supply. The projects must be able to deliver power to customers in winter afternoons and evenings. Massachusetts is expected to award contracts in December.

Deepwater Wind has also submitted alternative bids for a larger 288 MW version of the Revolution Wind project and a smaller 96 MW version, the company said in a statement.

“We can build a larger project if other New England states want to participate now or we can start smaller to fit into the region’s near-term energy gaps. And our pricing at any size will be very competitive with the alternatives," Jeff Grybowski, CEO of Deepwater Wind, said.

New Energy Update