US regulator rejects coal subsidy plan; New York to tender for 800 MW offshore wind

Our pick of the latest wind power news you need to know.

Related Articles

US FERC rejects government’s support plan for coal, nuclear

The U.S. Federal Energy Regulatory Commission (FERC) has rejected market rules proposed by the Trump administration to support coal and nuclear power generation.

Coal and nuclear power plants have been under pressure from rising renewable energy capacity and sustained low gas prices.

Proposals submitted by Energy Secretary Rick Perry in September required market operators to implement rules to allow the "full recovery of costs" of plants which provide grid reliability services and have a 90-day fuel supply on site, effectively directing the support at coal and nuclear generation.

The FERC has rejected these proposals, saying the Department of Energy (DOE) failed to demonstrate that existing electricity tariffs were "unjust and unreasonable," FERC said in a January 8 filing.

The commission has instead launched a new consultation “to enable us to examine holistically the resilience of the bulk power system,” calling on grid operators to submit specific grid resilience information within 60 days, it said.

"We have seen a variety of economic, environmental, and policy drivers that are changing the way electricity is procured and used...the Commission’s markets, transmission planning rules, and reliability standards should evolve as needed to address the bulk power system’s continued reliability and resilience," FERC said.

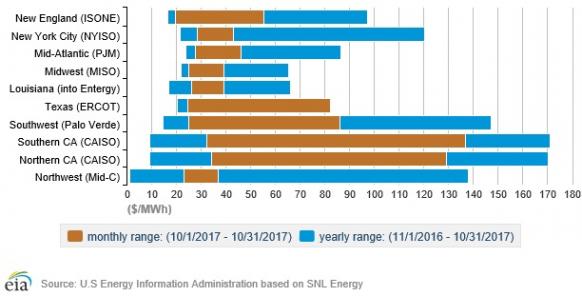

US electricity price ranges per market

(Click image to enlarge)

The FERC's new consultation aims to:

(1) Develop a common understanding between the FERC and the electricity industry of what resilience of the bulk power system means and requires.

(2) Understand how each Regional Transmission Organisation (RTO) and Independent System Operator (ISO) assesses resilience.

(3) Use this information to evaluate whether additional FERC action on resilience is required.

New York to tender for 800 MW offshore wind in 2018-2019

New York is to launch tenders for 800 MW of offshore wind power in 2018-2019 in a bid to be the leading U.S. offshore wind market, New York Governor Andrew Cuomo said in his annual state agenda January 3.

Last year, Governor Cuomo set a target of 2.4 GW of offshore wind by 2030.

Cuomo has also directed the New York State Energy Research and Development Authority (NYSERDA) to invest $15 million in development and training infrastructure for offshore wind construction, installation and operations and maintenance (O&M), the Governor's office said.

"To attract private investment in port infrastructure and supply chain activities, Governor Cuomo is also directing NYSERDA to work with Empire State Development and other State agencies to determine the most promising public and private offshore wind port infrastructure investments," it said.

Cuomo has also backed a state target of installing 1.5 GW of energy storage capacity by 2025, representing the largest commitment per capita by any state.

State agencies and authorities would work together this year to establish utility procurements of energy storage and advance regulatory changes in utility rates and wholesale energy markets to incorporate storage into renewable energy procurements, the Governor's office said.

The NY Green bank would provide some $200 million for storage-related investments and the NYSERDA will invest $60 million in pilot storage projects, it said.

Global offshore wind capacity to hit 115 GW by 2030: BNEF

Global offshore wind installations are expected to rise by 16% per year (CAGR) to 114.9 GW in 2030, Bloomberg New Energy Finance (BNEF) said January 8.

Global offshore wind capacity was 17.6 GW at the end of 2017 and the "core markets" of U.K., Germany, Netherlands and China will drive new projects, BNEF said.

However, the U.S. and Taiwan will also become "gigawatt markets" in the next decade and BNEF has raised its U.S. forecast by 85% following new U.S. state targets, it said. Growing installation experience, technology advancements and economies of scale have driven down offshore wind prices, stoking demand from U.S. state authorities.

BNEF has predicted the global offshore wind market will double by 2020 to 34 GW and installed capacity in China will surpass the UK in 2022. In a report published in August 2017, the research group said cumulative offshore wind capacity could reach 71 GW by 2025.

Global offshore installed capacity forecast

Note: ‘Other’ includes Finland, France, Ireland, Italy, Japan, Korea, Taiwan, U.S., Norway, Portugal, and Sweden.

Source: BNEF (2017).

BNEF's latest report predicts global offshore wind installations will peak in 2027 and slow down after 2028 due to the expiry of subsidies and a lack of regulatory transparency.

Germany's Nordex secures 820 MW US turbine contracts

German turbine supplier Nordex has signed contracts with two large international utilities to deliver a total of 820 MW for three U.S. wind farms, the company announced January 9.

One of the utilities ordered a total 196 turbines of capacity 3.15 MW for a 319 MW project and a 300 MW project. The third order was for a Texas wind farm, to which Nordex will supply 67 turbines of capacity 3 MW.

Delivery of the turbines will commence this summer, Nordex said.

Intense price competition has spurred consolidation in the wind turbine market. Nordex merged with Spain's Acciona in 2016 and this was followed by the merger of Siemens and Gamesa in 2017.

The merger of Siemens and Gamesa created a 'big four' of dominant global turbine manufacturers, with Denmark's Vestas, U.S. group GE and China's Goldwind.

New Energy Update