US offshore wind supply chain valued at $68bn; GE signs first split-blade 4.8 MW turbine contract

Our pick of the latest wind power news you need to know.

Related Articles

US offshore wind capex forecast to hit $68 billion by 2030

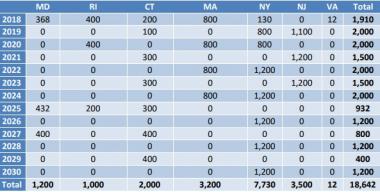

The value of the U.S. offshore wind supply chain is forecast to hit $68 billion by 2030 with 18.6 GW of new capacity contracted on the Atlantic coast, the University of Delaware said in a new report.

There is currently 1.6 GW of contracted U.S. offshore wind capacity and this will rise to around 4 GW by the end of 2019, according to the report.

Some 5.5 GW of new capacity is expected to be procured during 2020-2022, followed by 6.4 GW in 2022-2025, it said.

Forecast US offshore wind contracts by state

Source: University of Delaware's Special Initiative on Offshore Wind, March 2019

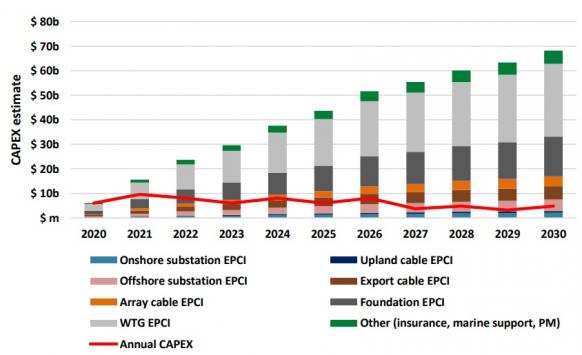

The 18.6 GW of new projects will require around 1,700 offshore wind turbines and towers, representing a market value of around $29.6 billion, the study said.

The value of turbine and substation foundations is estimated at $16.2 billion while $10.3 billion of cabling will be required, it said. The value of onshore and offshore substations is estimated at $6.8 billion and marine support, insurance and project management solutions at $5.3 billion, it said.

The report was published by the University of Delaware's "Special Initiative on Offshore Wind" and featured analysis by the Renewables Consulting Group (RCG).

Value of US offshore wind supply chain

(Click image to enlarge)

Source: University of Delaware's Special Initiative on Offshore Wind, March 2019.

GE signs first two-piece blade turbine contract in Germany

GE Renewable Energy has signed its first commercial contract for its new two-piece turbine blades with Germany's Prowind, the U.S. group announced April 2.

GE's new split blade design allows on-site assembly, reducing transport costs for larger turbines. Developers are seeking to install larger, higher efficiency turbines to lower costs and GE hopes the blades will unlock new projects in locations that are difficult to access.

GE will supply three 4.8 MW turbines with a rotor diameter of 158 meters and hub heights up to 161 m to Prowind's Elfershausen wind power project in central Germany.

The blades will be manufactured in Spain by GE subsidiary LM Wind Power and the blade tips will be installed on site. This will make it easier to transport the blades through the forests of Bavaria, the company said.

The turbines are "great fit for the unique characteristics of the Elfershausen project, thanks to the flexibility it offers in the transportation and the installation of its components and blades," Johannes Busmann, CEO and founder of Prowind, said.

"We are excited about this technology and where it can take us in our path towards driving down the Levelized Cost of Electricity (LCOE) together," Busmann said.

EU national climate plans lack permitting, end-of-life measures: WindEurope

European Union (EU) members are falling short on policy measures that ensure the EU reaches its target of 32% renewables by 2030, industry group WindEurope said in a statement April 4.

Draft 2030 National Energy and Climate Plans (NECPs) submitted by EU members lack sufficient detail on planned project tenders, permitting and end-of-life support measures, it said

Most of the draft plans do not include power auction schedules and only Germany provides an auction schedule out to 2030, WindEurope said.

In addition, no country has committed to simplify planning and permitting rules which restrict turbine heights and siting locations and increase development costs, it said.

The latest NECPs also failed to provide detailed policies that support end-of-life decisions.

Up to 60 GW of projects will reach the end of their operational life by 2030, according to WindEurope. Only six EU members-- Belgium, Denmark, France, Germany, Italy and Spain-- recognized the need for end-of-life solutions in their draft plans, WindEurope said.

The NECPs also failed to simplify corporate renewable Power Purchase Agreements (PPAs), a measure which is explicitly mandated in the EU Renewable Energy Directive.

The plans also provided few detailed proposals for electrifying heat and transport, WindEurope noted.

New Energy Update