COVID offshore spending kick tests operator margins

Offshore wind operators have invested in extra logistics capacity and turbine components during COVID-19 to space out workers and minimize supply risks.

Related Articles

The COVID-19 pandemic has tested the ability of offshore wind operators to adapt to new supply chain and logistics challenges.

In northern Europe, the outbreak came just ahead of the construction and scheduled maintenance season, leaving operators little time to test new protocols.

Like many industries, offshore operators have maximized homeworking but offshore teams face specific distancing challenges on vessels and offshore platforms.

Operators also face intense power market competition. To minimize costs, operators must meet demanding project schedules within limited weather windows.

Where possible, offshore operators have limited team numbers. They have also made bespoke investments to mitigate safety and financial risks, operators told New Energy Update.

Buying space

In recent years, offshore wind operators have used innovative team structures and technology enhancements to reduce the number of vessel trips per turbine and minimize costs.

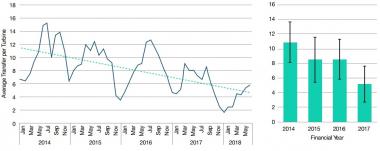

UK annual offshore transfers per turbine

(Click image to enlarge)

Source: ORE 'Catapult's System Performance, Availability and Reliability Trend Analysis – 2017/18 Portfolio Review'

Following COVID-19, operators have increased spending on logistics to reduce the risk to workers.

Canada's Northland Power, the sixth-largest offshore wind operator, has contracted additional crew transfer vessels and larger helicopters to put more space between workers, Florian Wuertz, Managing Director, Northland Power Europe, told New Energy Update.

Northland is majority stakeholder in two offshore wind farms in Germany and one in the Netherlands, comprising a total 1.2 GW of capacity.

The operator has separated offshore shift teams by stopping all physical meetings between shifts.

“For personnel on a [service operation] vessel, we have implemented very strict testing procedures prior to the start of shifts,” Wuertz said.

Northland also requires offshore workers to wear personal protection equipment (PPE) where physical distancing cannot be guaranteed, such as in lifts and on turbines. Offshore accommodation is restricted to single cabins only.

German operator RWE has also increased the number of vessels it uses and adapted team structures to reduce the chances of infection, Enrico Schafer, Head of Offshore Wind Operations Continental Europe at RWE Renewables, told New Energy Update.

RWE is the second largest offshore wind operator with an installed capacity of 2.5 GW.

In April, Belgium's DEME, an installer of offshore turbines, chartered a hotel ship to pre-quarantine workers and ensure safe crew changes.

“This will happen in small groups and according to a strict schedule, which makes it possible to separate the crews of different DEME vessels,” the company said in a statement.

Supply risks

Offshore wind operators are also investing to maintain efficient supply during COVID-19.

Northland acquired extra stock of critical equipment and spare parts to minimize supply chain risks, Wuertz said.

Leading offshore wind developer Orsted has maintained "normal" availability rates at its operational fleet during COVID-19, but construction risks were building, the company warned in its Q1 results April 29.

Orsted expects to reach an installed capacity of 7.5 GW by end of 2020 and hit 15 GW by 2025.

"Our construction projects all remain on track. However, across our projects, we see an increased risk of component and service delays from suppliers impacted by COVID-19," Orsted said.

"Based on our current outlook, we believe the COVID-19 related impact on our construction projects will be limited both in terms of timing and economics," it said.

Orsted reaffirmed its EBITDA guidance for 2020 at DKK 16-17 billion ($2.4-2.5 billion) and said it still expected to invest DKK 30 to 32 billion this year.

COVID-19 has however pushed back Orsted’s US project completion dates, it warned. COVID-19 combined with extended US approval processes has prompted Orsted to delay its expected commissioning dates for the 120 MW Skipjack project in Maryland and the 130 MW South Fork project in New York by around a year, to 2023.

Orsted's commissioning dates for larger US projects planned for 2023 and 2024 are also in doubt, the company said.

"We expect to have more clarity after the summer," it said.

Research resumes

Offshore wind laboratories have also implemented COVID-19 protection to pursue their research.

The UK’s Offshore Renewable Energy (ORE) Catapult resumed research, testing and validation operations at its National Renewable Energy Centre in Blyth in the Northeast of England after introducing distancing measures.

ORE Catapult has restarted research programs at blade, powertrain, electrical and subsea testing facilities at Blyth, the company told New Energy Update. The research group is also expanding its workforce and has continued to recruit staff through the pandemic.

ORE Catapult has segregated the Blyth site, kept team sizes as small as possible, and limited the number of people on site, Tony Quinn, ORE's Test Facility Director, said.

“We have restricted external contractors on site, employed to support our business, to essential work only. We have stopped any short-term agency workers but continue with long-term agency workers," Quinn said.

New normal

Even for offshore wind groups, homeworking is set to increase following COVID-19.

The pandemic has shown "the extent to which remote work is possible and effective,” Wuertz said.

All companies will need to mitigate the negative effects of remote working, including communication difficulties, feelings of isolation and demotivation, Wuertz noted.

"We have also experienced these challenges over the last months”, he said.

For ORE, increased homeworking has “generally worked very well for our business so far," particularly using the latest group call and messaging platforms, Quinn said.

Going forward, greater use of remote working could reduce the impact of other seasonal illnesses such as flu, he said.

COVID-19 has also helped operators road test business continuity procedures, Wuertz said.

“I expect to have much more robust processes and more documentation around core processes after the COVID-19 phase,” he said. "…to be prepared for the next challenge.”

Reporting by Neil Ford

Editing by Robin Sayles