California floating wind pioneers build new fishing, harbor frameworks

As California unveils its first offshore wind lease zones, pioneering floating wind developers have been securing fishing industry alliances and fleshing out infrastructure plans to accelerate deployment.

Related Articles

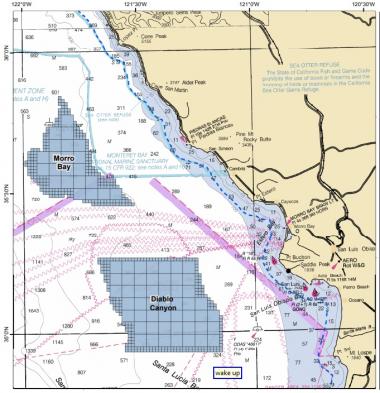

On October 19, the U.S. Bureau of Energy Management (BOEM) called for developers to submit information on nominations for commercial offshore wind leases in three designated areas off the California coast.

The three zones are situated off Morro Bay and Diabolo Canyon in central California and Humbolt Bay in Northern California, representing a total area of 687,823 acres.

California's deep offshore waters favor floating offshore wind projects and several developers have been developing large-scale facilities in these areas.

Developers are attracted by California’s strong and relatively constant offshore wind resources and state-level support for renewable technologies.

Castle Wind, a joint venture between Trident Winds and German power group EnBW, has already announced plans to build a 1 GW floating wind project in Morro Bay. The developer is looking to secure a grid connection which became available following the shutdown of the Morro Bay fossil fuel power plant and targets commercial start-up between 2025 and 2027.

California should look to install some 7 GW of offshore wind power, equivalent to 13% of the state’s electricity demand, Alla Weinstein, CEO of Castle Wind LLC, told New Energy Update.

This capacity “is achievable and would increase opportunities for the [wider] U.S. offshore wind market,” Weinstein said.

Central Coast offshore wind call area

(Click image to enlarge)

Source: BOEM, October 2018.

In the Humboldt Bay zone in Northern California, the Redwood Coast offshore wind consortium is developing a floating wind farm of capacity 150 to 200 MW. The project is being developed by a public-private consortium made up of Redwood Coast Energy Authority (RCEA), EDPR North America, Principle Power, Aker Solutions, H. T. Harvey & Associates and Herrera Environmental Consultants. Development and installation costs are estimated at around $0.5 billion and the project could be online by 2025.

“California has a world-class offshore wind resource,” Enrique Alvarez Uria, director of Offshore Projects at EDP Renewables (EDPR), a Redwood Coast project partner, said.

Supportive policy frameworks could see California become “a global leader in floating offshore wind development,” he said.

European experts

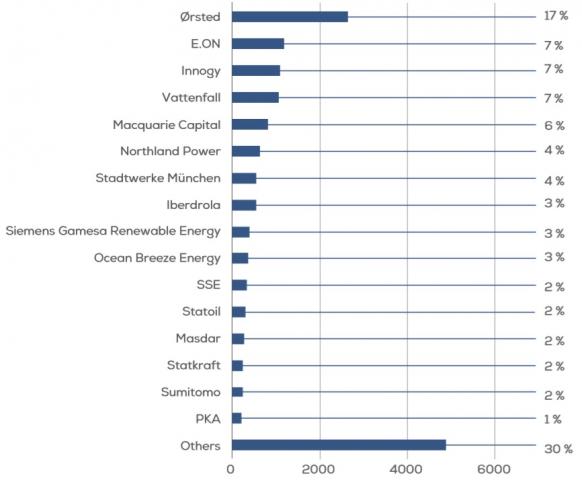

European offshore wind costs have plummeted in recent years and a number of established European offshore wind groups have partnered with U.S. companies to gain a share of the emerging U.S. offshore market.

Earlier this month, Denmark's Orsted acquired 100% of U.S. offshore wind developer Deepwater Wind at a price of $510 million. Orsted, a leading global offshore wind developer, will merge Deepwater's 3.3 GW U.S. offshore wind portfolio with its own 5.5 GW of potential projects, creating the largest U.S. offshore wind pipeline of any developer, it said.

Owners' share of Europe offshore capacity (end 2017)

(Click image to enlarge)

Source: WindEurope.

German utility ENBW joined the Castle Wind project in June, marking its entrance into the U.S. offshore wind sector by heading straight for floating wind technology and bypassing the more crowded U.S. East Coast offshore wind market.

ENBW has been heavily active in the European offshore wind sector. In April 2017, the company became one of the first offshore wind developers to acquire concessions at unsubsidized prices, bidding prices of zero euros per MWh to build fixed-bottom wind farms in German waters.

ENBW believes floating wind technology represents the future of offshore wind. The group sees California as a key growth market for offshore wind, citing its "strong economy, continuously growing energy demand and ambitious renewable energy and climate goals."

Fishing deals

The lease zones proposed by BOEM exclude areas close to the shore where there are higher concentrations of commercial and recreational fishing activities.

The BOEM has requested additional information on fishing activities and may exclude further areas if any issues cannot be resolved.

Offshore developers have already started to form alliances with local fishing communities to ensure a smoother development process.

On October 6, Castle Wind signed a mutual benefits agreement with the local commercial fishing organizations of Morro Bay and Port San Luis.

This "first of its kind" agreement aims to minimize anticipated impacts to commercial fishing communities while offering new business opportunities. Castle Wind will work with the fishing associations to minimize restrictions on commercial fishing in the project area and local fishermen will be offered training to participate in the offshore wind industry.

The RCEA development consortium has entered into a memorandum of understanding (MOU) with the Humboldt Fishermen’s Marketing Association, in which it commits to minimize and mitigate impacts of the commercial fishing industry “to the greatest extend possible.”

Infrastructure needed

Supply chain and infrastructure buildout is key to minimizing costs in the emerging U.S. offshore wind market.

U.S. developers will be able to leverage technology innovations, installation expertise and other cost savings gained in Europe, but this must be supported by local infrastructure buildout.

"We start halfway down the cost curve…What we need to focus on are things like ports and a trained workforce," Chris Wissemann, U.S. Representative at Innogy, a European renewables developer, told a conference in June.

The Redwood Coast project will require upgrades to the existing harbor infrastructure to support offshore wind growth, Matthew Marshall, Executive Director at the RCEA said.

“The consortium is working with the Humboldt Bay Harbor District and other stakeholders to move forward with defining and addressing the harbor infrastructure improvements that will be needed,” he said.

The Redwood Coast consortium has also been in contact with local unions and representatives to develop a skilled workforce for the offshore wind industry.

Supply chain measures such as these will help to cement a future for offshore wind in California and attract other players to the market.

While the Redwood Coast project is the most advanced on the northern coast, Marshall notes that “several offshore wind developers have expressed preliminary interest in the region.”

By Anna Flavia Rochas