US exempts bifacial panels from import tariffs; Nevada PV project proposes US' largest battery

Our pick of the latest solar news you need to know.

Related Articles

US exempts bifacial panels from Section 201 import tariffs

U.S. federal authorities have exempted bifacial solar panels from the Trump administration's Section 201 import tariffs, government documents show.

Imposed in 2018, the Section 201 tariffs are currently set at 25% and fall to 20% in 2020 and 15% in 2021.

U.S. demand for bifacial solar panels is soaring as developers seek new ways to improve project efficiency. Bifacial systems are forecast to represent 10% of the utility-scale market in 2019, rising to 30% by 2025, according to the National Renewable Energy Laboratory (NREL).

The exemptions for bifacial panels were included in the U.S. Trade Representative's "Exclusion of Particular Products From the Solar Products Safeguard Measure" document, published June 13.

The exemption applies for "bifacial solar panels that absorb light and generate electricity on each side of the panel and that consist of only bifacial solar cells that absorb light and generate electricity on each side of the cells," the document said.

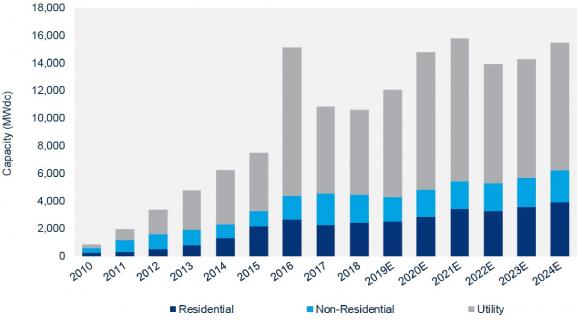

PV installations are set to hike in 2019-2021 as demand recovers from a dip in 2018, when uncertainty over the Section 201 tariffs delayed projects.

Wood Mackenzie and the Solar Energy Industry Association (SEIA) recently raised their five-year PV installation forecast due to higher volumes of project announcements and increasing demand from utilities and corporate offtakers.

US PV installation forecast by segment

(Click image to enlarge)

Source: Wood Mackenzie Power and Renewables, March 2019.

Nevada solar project includes US' largest battery

The proposed 690 MW Gemini Solar Project in Nevada includes 2,125 MWh of battery storage capacity, according to a draft environmental impact statement (EIS) published by the U.S. Bureau of Land Management (BLM) June 7.

The main sponsor for the project is PV developer Arevia Power, according to the federal government's permitting dashboard. The developer has proposed to install "approximately 425, 5-MWh, 4-hour battery systems with approximately 53,550 individual batteries (may be lithium ion), enclosed in a container and installed adjacent to each inverter," the EIS said. This could make it the largest battery storage facility in the U.S.

The Gemini plant would be located 33 miles north east of Las Vegas, immediately south of the Moapa River Indian Reservation.

NV Energy's Crystal Substation and an NV Energy high-voltage transmission line are located less than four miles to the west of the proposed site. Interstate 15 is less than half a mile to the west.

The BLM has opened a 90-day public comment period for the project.

Arevia Power was founded in 2015 by a team of utility-scale solar PV developers with 16 years combined experience.

Solar, wind sectors sign equal PPA volumes in Jan-May

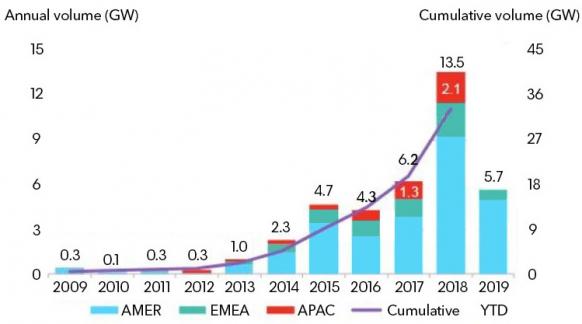

Some 2.8 GW of corporate solar power purchase agreements (PPAs) were signed in January-May, equalling wind PPA volumes, BloombergNEF (BNEF) said June 11.

Contracts in the Americas represented 86% of global PPAs so far this year, BNEF said.

In 2018, solar developers signed 5.7 GW of corporate solar PPAs while wind projects sealed 6.9 GW of deals.

Global corporate PPA volumes by region

(Click image to enlarge)

Source: BNEF, June 2019.

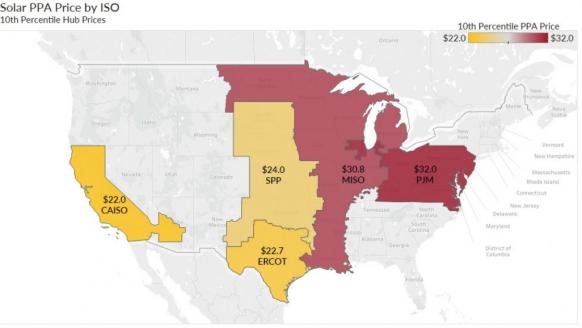

U.S. solar PPA prices fell in most markets in Q1 2019, with the largest decreases in California's CAISO, the north-east PJM and Texas ERCOT markets, platform provider LevelTen said in a report May 8.

Increased competition among developers and lower engineering, procurement and construction (EPC) costs had the greatest impact on costs, according to a market survey conducted by LevelTen.

10th percentile solar PPA prices by market in Q1 2019

(Click image to enlarge)

The P25 solar index, which represents the most competitive 25th percentile offer price, fell by 15% in California's CAISO market, LevelTen said.

In the Texas ERCOT market and the north-east PJM market, the index price fell by 6% and 3%, respectively. Prices in the central SPP market fell by 1% while prices in the Midcontinent MISO area rose due to higher prices at the Illinois, Indiana and Michigan hubs.

Wind prices fell less than solar prices on average and three markets recorded rising prices, LevelTen said.

"The P25 Index for wind prices increased moderately in three markets (CAISO, MISO and PJM), but a large decrease of 8% in ERCOT and a moderate decrease of 1% in SPP pushed the overall index down," it said.

Wind prices in CAISO and MISO rose by 4% and 5% over the quarter, respectively. In PJM, wind prices rose 1% while ERCOT saw prices plummet by 8%.

"The West Zone in ERCOT contributed the most to the drop, with an 11% decrease," LevelTen said.

In SPP, wind prices softened by 1% on the quarter, it said.

Dubai tenders for 900 MW of PV in fifth phase of giant solar park

The Dubai Electricity and Water Authority (DEWA) has launched a tender for a further 900 MW of PV capacity at the Mohammed bin Rashid Al Maktoum Solar Park.

DEWA has received letters of intent from 64 developers and companies will have until August 22 to submit their bids. The winning bidder will own 40% of the project and DEWA will own 60%. The capacity will come online in stages from Q2 2021.

The tender represents the fifth phase of the Mohammed bin Rashid Al Maktoum Solar Park, which will host 5 GW of solar capacity by 2030.

The first phase of the solar park involved 13 MW of PV capacity which was brought online in 2013. The second phase saw another 200 MW of PV power come online in March 2017. In the third phase, 800 MW of PV power will be operational by 2020.

The fourth phase consists of the 950 MW Noor Energy 1 CSP-PV project. Developed by Saudi Arabia's ACWA Power, this $4.4 billion project includes three 200 MW parabolic trough CSP systems, a 100 MW CSP tower plant, 250 MW of PV capacity and 15 hours of molten salt CSP storage capacity.

Construction of Noor Energy 1 is 7% ahead of schedule, DEWA said in May.

New Energy Update