US battery capacity set to double in 2021; ABB exits solar inverter market

Our pick of the latest solar news you need to know.

Related Articles

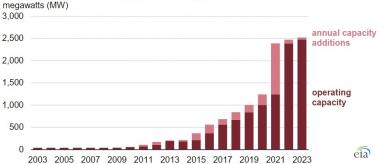

US to install over 1 GW of utility-scale battery capacity in 2021

U.S. installed utility-scale battery capacity is forecast to double in 2021 to around 2.4 GW, based on project proposals submitted by developers, the Energy Information Administration (EIA) said in a note published July 10.

Installed capacity was 900 MW at the end of March following 60 MW of new connections during the first quarter, EIA said.

US utility-scale battery capacity forecast

(Click image to enlarge)

Source: Energy Information Administration, July 2019.

Growth in utility-scale battery installations is being driven by state-level energy storage policies, Federal Energy Regulatory Commission (FERC) Order 841 that requires system operators to allow battery systems in wholesale and service markets, and increasing competitiveness of storage coupled with PV and wind plants.

In particular, rapid falls in solar and battery costs and rising renewable energy capacity have triggered a surge in U.S. PV plus storage projects. PV plus storage projects are spreading from Southwest markets into eastern and northern states and starting to compete with gas-fired generation. Co-locating the PV and storage systems reduces installed costs by 8% for DC-coupled system and 7% for an AC-coupled system, according to a recent study by the National Renewable Energy Laboratory (NREL).

The Los Angeles Department of Water and Power (LADWP) is set to agree a power purchase agreement (PPA) for 8minute Energy's planned 400 MW Eland solar plus storage plant at a record-low price of $19.97/MWh, media reported last month.

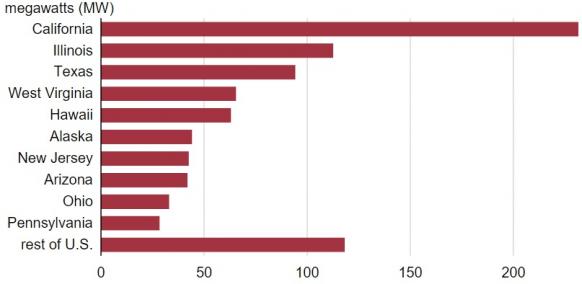

US utility-scale battery capacity by state (March 2019)

(Click image to enlarge)

Source: Energy Information Administration, July 2019.

Swiss group ABB exits solar inverter market

Swiss technology group ABB is to exit the solar inverter market by transferring its inverter business to Italy's FIMER and recording an after-tax non-operational charge of approximately $430 million, ABB announced July 9.

Around 75% of the charge represents cash paid to FIMER until 2025, ABB said. The company also expects up to $40 million of carve-out related separation costs starting in the second half of 2019.

ABB's announcement comes as global competition continues to pressure the margins of solar component suppliers.

“ABB’s solar inverter strategy probably cost it close to $1.5 billion in terms of investments, acquisitions, exit costs and ongoing losses since 2013, trying to benefit from the growth in renewables but through commoditized products,” Andreas Willi, Head of European Capital Goods Equity Research at JP Morgan, told Reuters news agency.

ABB's inverter business recorded revenues of $290 million in 2018 and employs around 800 people globally.

FIMER's solar business will be "greatly enhanced" by the acquisition and the company will "continue the excellent job carried out by ABB in recent years," Filippo Carzaniga, CEO of FIMER, said in a statement.

FIMER plans to develop new product platforms and innovative digital technologies in the energy sector, he said.

ABB will continue to integrate solar power into a range of smart technology solutions including smart buildings, energy storage and electric vehicle charging, Tarak Mehta, President of ABB's Electrification business, said.

Cypress Creek closes EPC division in new US growth strategy

U.S. solar developer Cypress Creek Renewables is to close its internal engineering procurement construction (EPC) business and focus on expanding in wholesale market regions, community solar and energy storage projects, CEO Sarah Slusser announced July 12.

Slusser was appointed earlier this year in a major overhaul of top-level management at Cypress Creek. Based in North Carolina, the company has an installed U.S. solar capacity of over 1 GW. In January, UK investment group Cubico Sustainable Investments agreed to buy 580 MW of U.S. solar projects from Cypress Creek.

"While continuing to invest in the Carolinas and PURPA markets, we will also advance development in dynamic wholesale markets, such as PJM and ERCOT, and maintain our leadership position within the community solar segment," Slusser said in a letter to employees July 12.

Cypress Creek will look to expand its customer base of corporate offtakers, hedge providers, municipalities, community solar subscribers, in addition to our utility customers," she said.

Internal EPC operations made business sense when Cypress Creek was focused on Carolinas projects but expansion in other markets will favor third-party models, Slusser told employees.

"Going forward, we will rely on [EPC] providers who have expertise in the local markets or have the footprint to effectively deliver projects nation-wide. The model allows Cypress to focus on the core business of developing, financing and operating solar and storage," she said.

New Energy Update