Inverter groups maintain output but COVID-19 set to inflate prices

Inverter suppliers are using flexible supply and production to minimize delivery risks but the pandemic will increase costs, experts told New Energy Update.

Related Articles

The COVID-19 crisis has created both supply and demand problems for PV component suppliers.

Lockdowns and travel restrictions have severely disrupted supply chains and delayed new projects, slicing demand outlooks.

Analysis group IHS Markit now predicts annual global PV installations will fall 16% this year to 105 GW, the research group said March 31.

Europe could see a much larger drop, IHS Markit said. Previously, the group had predicted installations in Europe would rise by 5% in 2020 to 24 GW.

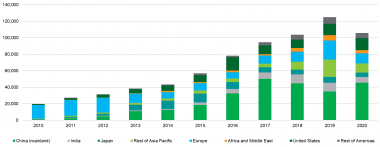

Global annual PV installations by region

(Click image to enlarge)

Source: IHS Markit, March 2020

Leading inverter suppliers like Germany’s SMA Solar and Spain’s Power Electronics are adapting their businesses to meet the short and long-term challenges of the COVID-19 crisis.

SMA's inverter orders were strong before the crisis and the company is maintaining full output capacity. SMA still expects to sell 14 to 15 GW of inverters this year, compared with 11.4 GW in 2019, Ulrich Hadding, the group's Chief Financial Officer, told New Energy Update.

The pandemic will "certainly have an impact on demand over the next three to four months, after which we expect a strong recovery," Hadding said.

Power Electronics, the largest supplier of inverters to US utility-scale projects, is also maintaining its 2020 US outlook, at 12 GW, a similar level to 2019 when early safe harbour orders to meet tax credit deadlines boosted order numbers.

"It’s hard to say how packed Q3 and Q4 will become, or how compacted Q4 will be if we see too many push outs into that quarter...this is uncharted territory for all of us," Ron Puryear, Vice President and General Manager of Power Electronics, said.

"The secret sauce will be whether or not the panels can catch up to the project time lines," Puryear said.

IHS Markit expects a ”limited overspill” of US utility-scale projects to shift from H2 2020 to H1 2021, Cormac Gilligan, an associate director at IHS Markit, said.

Developers and EPCs are likely to safe harbour key components in a similar way to 2019 to fulfil end of year tax credit deadlines, he said.

Securing parts

Component supply remains a challenge for inverter groups and SMA has activated "second source" suppliers in countries and regions that are less affected by COVID-19 restrictions, Hadding said.

Transport capacity limitations have increased costs, he warned.

Grounded passenger flights have severely curbed air freight options while sea freight container capacity is also limited, Hadding said.

The company is working closely with suppliers to find solutions, he said.

"Typically, air freight costs negatively impact gross margins in the low single digits in gross margins terms," Miguel De Jesus, a solar market analyst at IHS Markit, told New Energy Update.

Power Electronics sources components from Europe, where most countries have been locked down for weeks.

For now, Power Electronics is running its US factory in Arizona at full capacity, Puryear said.

The US division holds a large inventory of components and is well-placed "to weather the storm, but not if things remain locked down for another month or two," he said.

Spain and Italy have seen the greatest number of factory closures and most European countries are starting to ease restrictions as death tolls soften. On April 13, the Spanish government allowed manufacturing and construction to restart after a two-week ban of all non-essential work.

"We seem to be in good shape with our current suppliers keeping up," Puryear said.

Full output

Along with common measures such as face masks, SMA has adapted production processes to protect employees and maintain 100% production capacity.

Using flexible working arrangements, SMA is able to adjust production at short notice and fulfil customer orders, Hadding said.

"Our production has been highly flexible even before the crisis...we are working with temporary workers, etc," he said.

"Even in Europe...many PV inverter manufacturers have been able to maintain manufacturing levels with limited to no disruption due to their businesses being associated with critical businesses such as energy," De Jesus said.

To minimize the financial impact, SMA has taken advantage of liquidity protection measures introduced by various countries, including measures that delay tax and social security payments, Hadding said.

"Those measures will be upheld as long as legally feasible," he said.

Price impact

Experts predict the ongoing COVID-19 crisis will lead to slower falls in inverter prices than seen in previous years.

"As PV inverter prices are already at low levels, IHS Markit forecasts price declines of 10% year on year...in some years historically, price reductions have exceeded 20%," Gilligan said.

"The planned decline of our sales prices might soften a bit, for specific products in certain countries we might even see price increases," Hadding said.

The inverter market has seen significant consolidation in recent years. Suppliers such as Advanced Energy, Satcon, Bonfiglioli and Bosch have exited the market while Siemens and Fimer have both acquired inverter businesses.

Hadding predicts further consolidation in the inverter supply chain in the coming years.

"It will become more difficult to keep up a smooth supply chain. Supply security will get a higher priority compared to low prices," he noted.

"Given the rapid reduction of demand in certain markets globally, it is expected that some consolidation will occur and suppliers will consider numerous options such as divestment, mergers or full exit," Gilligan said.

Survival strategy

For the wider PV sector, the swamping effect of the COVID-19 pandemic risks demoting the importance of the global climate challenge.

The increasing competitiveness of solar power plants will help companies tackle the long-term challenges and green deals between governments and the private sector could help accelerate the wider recovery.

Despite the current challenges, SMA is maintaining its 2020 financial outlook of a sales increase of 1.0 to 1.1 billion euros ($1.1-$1.2 billion) and EBITDA increase of 50 to 80 million euros. Going forward, the company is implementing additional measures to improve the flexibility and cost effectiveness of its operations, Hadding said.

As the renewable energy market grows, diversification will be key to ensure business stability.

"We see good growth potential over the coming years for SMA in the field of digital energy solutions, but also storage system technology, and services such as operations and maintenance (O&M) for utility-scale PV power plants," he said.

For Power Electronics, key growth markets include energy storage and electric vehicles.

"Our move into the electric vehicle business has been a good one, we have big long term plans here," Puryear said.

Robin Sayles