Global PV installs to roar back in 2021; US utility-scale boom eclipses COVID dip

Our pick of the latest solar news you need to know.

Related Articles

PV installs to bounce back in 2021 as economic aid kicks in

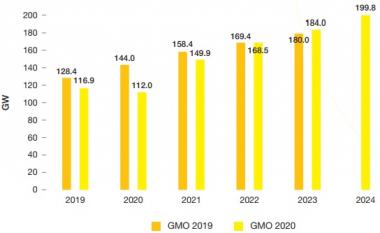

Global solar installations are set to recover sharply in 2021, climbing 33.8% year-on-year to 149.9 GW following a boost from COVID-19 stimulus packages, industry group SolarPower Europe said in its latest annual Global Market Outlook (GMO).

Following COVID-19 lockdowns, SolarPower Europe has cut its forecast for 2020 from 144 GW, to 112 GW. Rooftop PV installations have been particularly affected, due to a lack of access to buildings and revised spending plans of households and business owners in the economic downturn, it noted.

Economic aid will help solar installations rebound in 2021 and reach a parity with pre-COVID estimates by 2022, when 168.5 GW of new capacity is forecast, the report said.

Forecast global solar installations

(Click image to enlarge)

Source: SolarPower Europe's 2020 Global Market Outlook (GMO).

State support packages include the European Union's 750 billion-euro ($847.3 billion) Next Generation EU plan, which will supplement a new European Green Deal, and Japan's $1 billion support package for corporate renewable power purchase agreements (PPAs).

"Now, governments have the opportunity to accelerate the energy transition and realize the structural benefits renewables can bring regarding economic development and job creation," SolarPower Europe said.

"With the right policies they can enable low-cost solar to reach its full potential and lead the energy transition," it said.

US solar installs set to rise by a third despite COVID

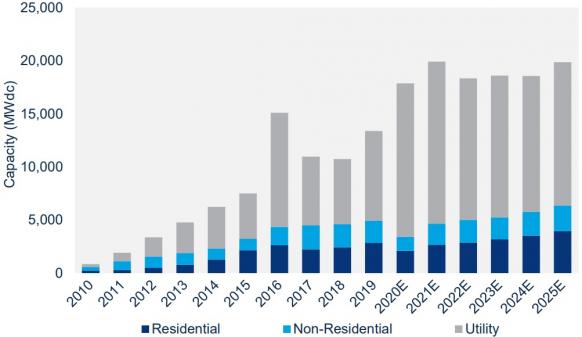

US solar installations are forecast to rise 33% in 2020 to 18 GW as strong demand for utility-scale projects outweighs the impact of COVID-19 lockdowns, according to the latest quarterly market report by the Solar Energy Industry Association (SEIA) and Wood Mackenzie. Prior to the crisis, the groups had forecast almost 20 GW of installations this year.

Some 14.4 GW of utility-scale projects are now forecast to be installed in 2020, the report said.

"Record utility-scale procurement totals in 2019 and Q1 2020 positioned the segment for a record year, even as large-scale projects face some construction delays and challenges in financing and developing early-stage projects," it said.

Installations of distributed solar projects are expected to drop by 31% in 2020 due to lockdown restrictions and lower investment appetite during the recession. By 2021, distributed solar activity will recover close to 2019 levels, the report said.

The US solar market is now forecast to install 113 GW of capacity in the period 2020-2025, down by 3.6 GW compared with pre-COVID predictions, it said.

Forecast US solar installations by segment

(Click image to enlarge)

Source: Wood Mackenzie, SEIA (June 2020)

Wood Mackenzie clips long-term O&M growth forecast

Annual global spending on solar operations and maintenance (O&M) is forecast to hit $9.4 billion by 2025, a year later than forecast in October 2019, Wood Mackenzie said in a new report. Despite short-term COVID-19 challenges, total O&M spending will continue to rise as installed capacity grows and ageing plants require component replacement or repowering.

Some $4.1 billion of the spending will be in the Asia-Pacific (APAC) region, while $3.5 billion will be spent on projects in Europe Middle East and Africa (EMEA) and $1.8 billion in the Americas, the report said.

In Europe, inverter repowering will be a key driver of spending, Wood Mackenzie said. Inverters are typically replaced after around 10 years, sometimes earlier.

"More than 16 GW of systems are currently over ten years old. By 2025, that number will grow to 100 GW," it said.

Intense competition between O&M suppliers prompted further market consolidation in 2019. The top 15 O&M suppliers increased their global market share from 51% to 54%, Wood Mackenzie said. Of the 12 markets examined in the report, only Germany, the UK, the US and France showed no consolidation last year.

In Spain, the share of the O&M market held by the top five players soared from 9% in 2018 to 71% last year, it said.

New Energy Update