Europe hikes 2020 solar forecast to 24 GW; US solar PPA prices close in on wind

Our pick of the latest solar news you need to know.

Related Articles

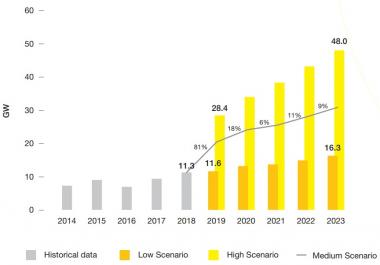

Europe annual PV installs forecast to hit 24 GW by 2020

Industry group SolarPower Europe has raised its installation forecast for 2019-2013, predicting annual installations will soar by 81% this year to 20.4 GW and climb to 24.1 GW in 2020 under its Medium scenario.

Last month, analysts at Wood Mackenzie predicted lower installation rates of 16.9 GW in 2019, rising to 20 GW by 2021.

Falling costs, particularly due to Chinese oversupply, and deadlines to meet 2020 European Union renewables targets, have boosted short-term demand for projects, SolarPower Europe said in its latest annual Global Market Outlook.

SolarPower Europe has also raised its growth forecasts for 2021-2023, now predicting a shorter gap between 2020 deadlines and the next surge of projects based on demand for solar from utilities, corporates and investment funds.

By 2023, annual installations could rise to around 30 GW, it said.

Forecast annual PV installs in Europe

(Click image to enlarge)

Source: SolarPower Europe's 'Global Market Outlook For Solar Power 2019-2023' report, May 2019.

Germany is forecast to remain the largest solar market in Europe in the next five years, installing around 26.7 GW of new capacity, SolarPower Europe said. Spain is forecast to be the second largest market, installing 19.5 GW and Netherlands in third place at 15.9 GW.

"Recent solar developments in [Spain and Netherlands] – strong political backing, current high installation activity, and large pipeline – are providing a solid foundation to assume that demand will be very strong until 2023," the industry group said.

SolarPower Europe downgraded its outlook for Turkey, where a currency and debt crisis and lack of support for solar projects saw installations slump from 2.6 GW in 2017 to 1.6 GW in 2018.

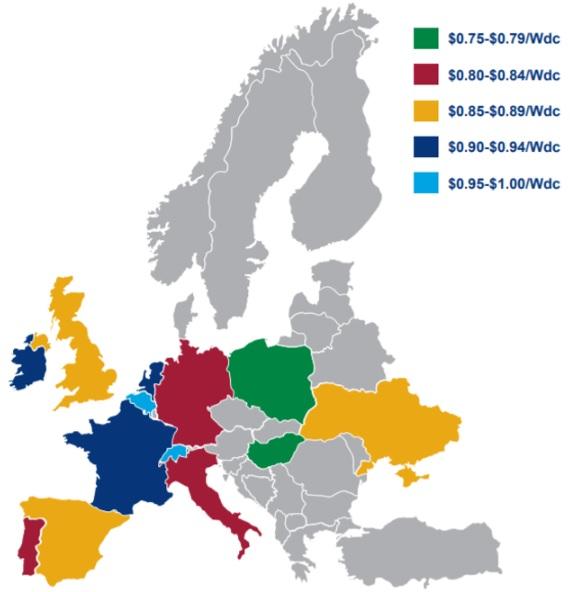

Forecast PV installs, political support by country

(Click image to enlarge)

Source: SolarPower Europe's 'Global Market Outlook For Solar Power 2019-2023' report, May 2019.

Competitive auctions will continue to drive utility-scale PV growth, Wood Mackenzie said in its outlook.

In France and Germany, some 19 GW of new capacity is scheduled to be tendered between 2019 and 2024, Wood Mackenzie said.

Italy is also due to launch joint onshore wind and solar auctions pending regulatory sign-off from the European Commission (EC), it said. In Spain, developers are building 3.9 GW of projects awarded in 2017 and there are around 10 GW of subsidy-free projects under development.

Average utility-scale system costs are predicted to be $0.87/Wdc in 2019 across all major European markets, Wood Mackenzie said.

By 2024, PV system costs in Europe are forecast to drop by 25%, on average, it said.

Europe utility-scale PV system costs in 2019

(Click image to enlarge)

Source: Wood Mackenzie, April 2019.

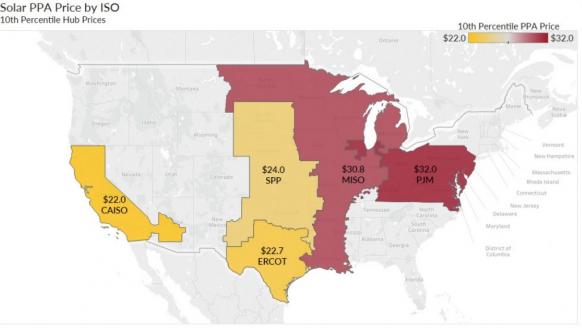

Falling costs push US solar PPA prices towards wind

U.S. solar power purchase agreement (PPA) prices fell in most markets in Q1 2019, with the largest decreases in CAISO, PJM and ERCOT, market platform provider LevelTen said in a report May 8.

Increased competition among developers and lower engineering, procurement and construction (EPC) costs had the greatest impact on costs, according to a market survey conducted by LevelTen.

10th percentile solar PPA prices by market in Q1 2019

(Click image to enlarge)

Source: LevelTen, May 2019.

The P25 solar index, which represents the most competitive 25th percentile offer price, fell by 15% in California's CAISO market, LevelTen said.

In the Texas ERCOT market and the north-east PJM market, the index price fell by 6% and 3%, respectively. Prices in the central SPP market fell by 1% while prices in the Midcontinent MISO area rose due to higher prices at the Illinois, Indiana and Michigan hubs.

Wind prices fell less than solar prices on average and three markets recorded rising prices, LevelTen said.

"The P25 Index for wind prices increased moderately in three markets (CAISO, MISO and PJM), but a large decrease of 8% in ERCOT and a moderate decrease of 1% in SPP pushed the overall index down," it said.

Wind prices in CAISO and MISO rose by 4% and 5% over the quarter, respectively. In PJM, wind prices rose 1% while ERCOT saw prices plummet by 8%.

"The West Zone in ERCOT contributed the most to the drop, with an 11% decrease," LevelTen said.

In SPP, wind prices softened by 1% on the quarter, it said.

New Energy Update