Europe annual PV installs to hit 20 GW by 2021; Duke Energy wins 6 of 14 new Carolinas projects

Our pick of the latest solar news you need to know.

Related Articles

Europe PV installs to hike 69% in 2019, surpass 20 GW by 2021

Europe annual PV installs are forecast to hike by 69% in 2019 to 16.9 GW and rise to 20 GW by 2021, Wood Mackenzie said in a report published April 26.

"Europe's solar market is undergoing a resurgence...Countries are rushing to meet their 2020 climate-energy obligations, while targets for 2030 are currently under review," the research group said.

France has set a solar target of 20 GW by 2023, while Italy has targeted 50 GW by 2030, it noted.

Competitive auctions will continue to drive utility-scale PV growth, Wood Mackenzie said.

In France and Germany, some 19 GW of new capacity is scheduled to be tendered between 2019 and 2024. Italy is also due to launch joint onshore wind and solar auctions pending regulatory sign-off from the European Commission (EC). In Spain, developers are building 3.9 GW of projects awarded in 2017 and there are around 10 GW of subsidy-free projects under development, Wood Mackenzie said.

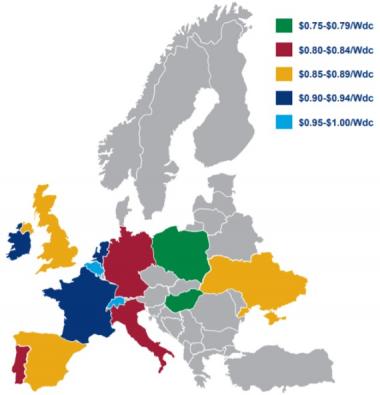

Average utility-scale system costs are predicted to be $0.87/Wdc in 2019 across all major European markets, Wood Mackenzie said.

By 2024, PV system costs in Europe are forecast to drop by 25%, on average, it said.

Europe utility-scale PV system costs in 2019

(Click image to enlarge)

Source: Wood Mackenzie, April 2019.

Advisory group DNV GL launches PPA buyer platform

Energy advisory and certification group DNV GL has launched a new digital platform to streamline procurement of power purchase agreements (PPAs) for renewable energy projects.

The web-based platform screens and benchmarks projects based on DNV GL’s scoring methodology, helping energy buyers to accelerate the procurement process, DNV GL said April 29.

The platform also provides best practices, guidelines and standardized contracts to share lessons learned, it said.

The global corporate renewable PPA market is growing fast as companies capitalize on falling costs to meet rising sustainable development targets.

The U.S. has led PPA growth but demand in Europe is increasing as a growing number of industrial groups and smaller businesses enter the market.

Growing demand from smaller offtakers is driving new PPA structures which include multiple counterparties and multiple contract durations.

“The corporate PPA market needs to significantly scale up to avoid being a bottleneck in financing and building renewables. This growth in corporate PPAs will require an efficient and transparent market where stakeholders understand and mitigate emerging risks," Caroline Brun Ellefsen, DNV GL's Global Head of the new platform, said.

Carolina states award 14 solar projects for 600 MW; Duke to develop six

Some 14 solar projects for 602 MW have been awarded in Duke Energy's power network in North and South Carolina, of which six will be developed by Duke Energy, the utility announced April 17.

There were 10 projects selected in North Carolina and four projects in South Carolina. Two of the projects will couple solar with battery storage.

Duke Energy will purchase power from the facilities under the regional Competitive Procurement of Renewable Energy (CPRE) program. The 14 selected projects were the most competitive out of 78 bids, the utility noted.

Projects to be developed by Duke Energy

- Duke Energy Carolinas: 69 MW – Catawba County, N.C.

- Duke Energy Carolinas: 25 MW – Gaston County, N.C.

- Duke Energy Renewables: 50 MW – Cleveland County, N.C.

- Duke Energy Renewables: 22.6 MW – Surry County, N.C.

- Duke Energy Renewables: 22.6 MW – Cabarrus/Stanly counties, N.C.

- Duke Energy Progress: 80 MW – Onslow County, N.C.

Duke Energy is helping to drive solar growth in the U.S. Southeast, particularly in North Carolina where it is the dominant power supplier.

The company has chosen to self-operate its renewable assets rather than extend warranty periods or use third-party operations and maintenance (O&M) providers.

Growing scale and expertise in renewables have allowed Duke Energy to expand into the highly-competitive O&M market. By the end of 2018, the company’s Renewable Services subsidiary had long-term operator or O&M contracts in place for over 1.5 GW of third-party wind and solar facilities.

Duke to sell stakes in 48 US renewables assets to infrastructure fund

Duke Energy has agreed to sell large minority stakes in 48 operating wind, solar and battery assets to John Hancock Infrastructure Fund, a division of Manulife Financial Corporation.

Duke Energy will sell 49% of 37 operating wind, solar and battery storage assets and 33% of 11 operating solar assets, the utility said April 24.

The total enterprise value of the assets is estimated at $1.3 billion including debt. Duke Energy will receive $415 million of pre-tax proceeds from the sale, it said.

Under the agreement, John Hancock will also have the right to acquire a minority interest in certain future solar and wind projects.

“We will continue to develop projects, grow our portfolio and maintain overall operational responsibilities for the projects just as we do today," Rob Caldwell, president of Duke Energy Renewables, said.

New Energy Update