Bifacial solar plants can generate 7% higher returns, US model shows

Machine learning models predict returns for U.S. bifacial plants are 2.5% to 7% higher than mono-facial designs, depending on the region, Itai Suez, Senior Solar Project Engineering Manager at developer EDP Renewables (EDPR), told the PV Operations Dallas 2019 conference.

Related Articles

The market for bifacial solar modules looks set to take off this year as developers seek new ways to increase efficiency and fend off aggressive price competition.

Leading tracker supplier NEXTracker is reportedly involved in over 750 MW of new bifacial solar projects in the U.S., including Invenergy's trailblazing 160 MW Southern Oak project in Mitchell County, Georgia.

Invenergy completed construction financing for Southern Oak in January and the plant is due online this year. Located on reflective desert land, the project will incorporate LONGi bifacial modules and NEXTracker single axis trackers. Power output from the PERC cell system will be 25% higher than a traditional monofacial module with fixed rack PV system, LONGi said.

In April, Enel Green Power installed its first bifacial solar panels at the 220 MW Magdalena II solar plant in Tlaxcala, Mexico. Also due online in 2019, the plant will supply industrial customers via Mexico's wholesale market pool.

Advanced modelling of utility-scale solar economics shows that optimized bifacial plants offer much higher returns than mono facial designs, Itai Suez, Senio Solar Project Engineering Manager at Portuguese group EDP Renewables (EDPR), told the conference in Dallas on April 17.

A major global wind developer, EDPR aims to build up to 2 GW of solar power in 2019-2022.

EDPR has used machine learning software to model how financial and design decisions for U.S. solar plants impact the internal rate of return (IRR).

Modelling of a project site in Georgia with relatively high irradiance levels predicts an IRR for an optimal bifacial plant (PERC cells) at around 9.2%, around 50 basis points (over 5%) higher than for the optimal mono-facial design, Suez told the conference.

At U.S. sites which have sunnier, clearer sky conditions, the predicted IRR gain for bifacial plants is lower, but still favors bifacial over mono-facial projects, Suez said.

"In the worst of places it can be as little as 2.5%, in the best places it can be 6 to 7%...that is game changing, that is disruptive," he said.

Market share

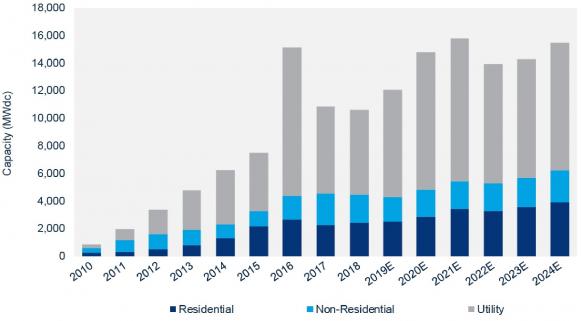

U.S. utility-scale solar installations are forecast to rise from 7.8 GW in 2019, to over 10 GW in 2020-2021, Wood Mackenzie and the Solar Energy Industry Association (SEIA) said in their latest quarterly U.S. Solar Market Insight report.

US PV installation forecast by segment

(Click image to enlarge)

Source: Wood Mackenzie Power and Renewables, March 2019.

Bifacial systems are forecast to represent 10% of the utility-scale market in 2019, rising to 30% by 2025, according to the National Renewable Energy Laboratory (NREL).

This could mean around 1 GW of bifacial solar projects in 2019 and much higher levels in the coming years.

"That's a remarkable change from literally nothing today," Suez told the conference.

Forecasters may also be underestimating overall solar growth in the coming years.

The U.S. solar industry has consistently beaten price and growth forecasts and data from Wood Mackenzie and SEIA shows there is around 4.4 GW of solar projects under construction, 22.3 GW of signed solar power purchase agreements (PPAs) and a further 38.8 GW of announced pre-contract projects, Suez noted.

"These PPAs are being contracted for [commercial operation dates] that are in the next couple to three years...This is what the U.S. solar market looks like from a contracting standpoint," he said.

Building data

Modelling practices will need to evolve to improve the accuracy of performance predictions and monitoring for bifacial designs, Suez told the conference.

Bifacial developers must take into account a greater number of different solar irradiance metrics and these must be characterized and monitored to reduce uncertainty.

Key modelling assumptions include bifaciality factors (the ratio of rear side efficiency versus front side), albedo values for ground reflectiveness, module height and shading considerations.

Developers must seek greater granularity of albedo values and anistrophy (directional dependence) to improve modelling accuracy, Suez said.

Diffuse shading from trackers can also significantly impact performance and ground-reflected spectrums are very different from sky spectrums, he said.

Different ground conditions such as grass, dirt, wet dirt, dry sand, snow have vastly different reflective properties and developers may look to layer the ground with local materials to maximize reflectiveness, Suez said.

"The economics of increasing your albedo fraction from 0.2 to 0.6 could be almost double your performance gain...this effect is pretty dramatic," he said.

Tracker type and height from the ground are also critical factors.

Increasing the tracker height for a single portrait system from 1.5 meters to around 2.5 m could increase annual output by as much as 0.75%, Suez said.

Further advances

EDPR is building a new pilot bifacial project this year on which it will test factors such as the impact of vegetation height on performance.

Current industry-standard models do not include many of the metrics specific to bifacial plants and may be underestimating performance, Suez noted.

"They will tend to be a little bit more conservative than reality... That's why we have to build test systems," he said.

Going forward, a shift towards n-type PERT (diffused rear surface) cells and subsequently heterojunction cells will further improve the business case for bifacial projects, Suez said.

Bifaciality factors could rise from current levels of around 70% to close to 100% and this could increase energy production by “over 2.5%," he said.

New Energy Update