Batteries could offset price risk for merchant solar

Bullish wholesale price assumptions may overvalue equity returns for merchant solar plants and owners should consider storage coupling to boost economics, Pietro Radoia, Solar Analyst at BNEF, told the PV Operations Europe 2018 conference.

Related Articles

Surging demand from pension funds and institutional investors has boosted acquisition activity for PV projects. 10-year government bond yields have fallen in recent years and investors have seen solar power projects as a good alternative for long-term returns.

European PV acquisition activity soared between 2008 and 2015 and buying activity has remained above 2 GW for the last three years, measuring 2.2 GW in 2017, according to BNEF data. The UK market continues to dominate acquisitions in Europe, representing 1.2 GW in 2017. Other significant markets included Spain, Italy, Portugal and France.

High investor demand for a relatively small supply of PV projects has driven down project prices and squeezed equity returns, prompting some investors to seek alternative investment strategies, Radoia told the conference in Munich on February 13.

Data on disclosed acquisition value shows UK project prices have fallen from $10-$15 million/MW in 2008 to $1-$2 million/MW in 2017-2018, he said.

In response, some investors are instead seeking to acquire and bundle untapped commercial scale PV assets into larger portfolios, investing in markets outside of Europe, or investing earlier in the development process to increase returns, Radoia said.

Another strategy gaining interest is investing in merchant solar plants, however Radoia warned many price assumptions appear highly optimistic and could over-estimate investor returns.

Wholesale risk

According to BNEF data, there is currently around 450 MW of European solar capacity under construction or recently built on an entirely merchant basis.

Merchant PV plants under construction or built (Europe)

Data source: Bloomberg New Energy Finance (BNEF), February 2018.

Merchant developers typically aim to lock in a long-term power purchase agreement (PPA), but very few of these have been signed given the descent of wholesale power prices in recent years and technological advances which continue to disrupt power markets.

According to Radoia, many solar investors are using bullish assumptions for wholesale power prices going forward.

For example, some investors' estimates for UK power prices in 2040 are 40% higher than BNEF's price forecast of 66 pounds/MWh, he said.

Such differences in power price assumptions have a dramatic impact on forecast equity returns.

At higher price assumptions, investors have forecast an internal rate of return (IRR) for UK merchant solar projects of 14% in 2025, while BNEF estimates equity IRR UK at around 2 to 3%, Radoia said.

"We think merchant projects in the UK are only going to be profitable in [around] 2030," he said.

One way in which merchant plant owners can improve project economics is by coupling plants with storage capacity, Radoia said.

"Batteries could salvage merchant projects," he said.

Storage support

Energy storage will be a key growth area for solar investors in the coming years. In Europe and the U.S., falling storage costs and rising solar renewable energy penetration is improving the economics of PV plus storage projects.

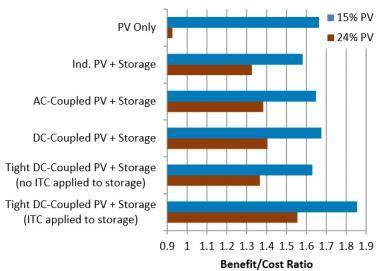

Forecast benefit vs cost of PV with storage (California)

(Click image to enlarge)

Source: U.S. National Renewable Energy Laboratory (NREL), 2017.

Reforms to ancillary market frameworks are expected to generate multiple revenue streams for solar-plus-storage developers. In the UK, the National Grid has already issued tenders for fast frequency response services from energy storage applications and the grid operator is currently consolidating and simplifying numerous ancillary services contract tenders, following a 2017 review on grid balancing requirements.

Last September, solar developer Anesco officially launched the U.K.'s first subsidy-free solar-plus-storage facility. The 10 MW Clayhill plant in southern England uses solar panels and five battery storage units supplied by China's BYD. Huawei supplied 1,500 Volt inverters, the first deployment of these in Europe.

Modelling by BNEF has shown merchant solar developers can significantly increase equity returns by coupling batteries to projects, Radoia said.

"Investors can reach 12% IRR in the UK if they combine merchant projects with a battery which provides frequency regulation services today," he said.

New Energy Update