Lointek, Aalborg win contracts on giant Dubai CSP project; Spain aims to install 2.5 GW CSP by 2025

Our pick of the latest solar thermal news you need to know.

Related Articles

Lointek to deliver steam generation, storage systems to Dubai's Noor Energy 1

Spain's Lointek is to supply the integrated steam generation system and oil salt thermal storage system for ACWA Power's 950 MW Noor Energy 1 CSP-PV plant in Dubai, the company said in a statement February 19.

Under a turnkey contract, Lointek will engineer, manufacture, install and commission the power island.

The $4.4 billion Noor Energy 1 project includes three 200 MW parabolic trough systems supplied by Spain’s Abengoa, a 100 MW central tower plant supplied by U.S. developer BrightSource and 250 MW of PV capacity. The plant will host some 15 hours of molten salt CSP storage capacity and is scheduled to be brought online in phases in 2021-2022.

Shanghai Electric is the contracted Engineering, Procurement, and Construction (EPC) supplier for the project. In January, Germany's Siemens won a contract to supply four steam turbine generators and auxiliary equipment to the project. The Siemens supply contract includes three 206 MW turbines for the three parabolic trough units and a 108.5 MW turbine for the central tower unit.

The Dubai Electricity and Water Authority (DEWA) has awarded the plant a 35-year power purchase agreement (PPA) at a record-low levelized tariff of $73/MWh. The storage system will allow the plant to supply power 24 hours a day, 365 days a year.

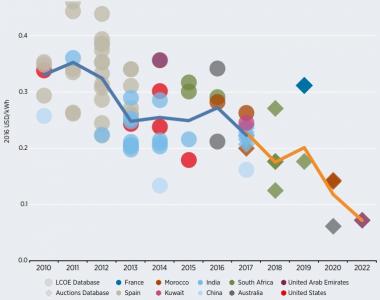

Global CSP costs, auction prices

(Click image to enlarge)

Source: International Renewable Energy Agency (Irena), January 2018.

The $4.4 billion cost of Noor Energy 1 will be met by $2.9 billion of debt and $1.5 billion of equity. DEWA is to provide $750 million, half of the project equity. Of the remaining half, ACWA Power will provide 51% and China's Silk Road Fund 49%. Over 70% of the project debt will come from Chinese banks including Industrial and Commercial Bank of China Limited (ICBC), with the remainder supplied by international and regional banks.

Lointek has supplied power systems for 3.5 GW of installed CSP capacity, representing around 70% of the global market, according to the company.

Aalborg wins contract on steam generator system

Denmark's Aalborg CSP is to supply its header-and-coil technology to the steam generator systems for the 600 MW parabolic trough section of the Noor Energy 1 plant, the company said in a statement February 18.

Aalborg's steam generator system is a 100% welded coils design based on steam boiler technology, rather than the conventional U-tube system design.

The welded design eliminates leakages, improving availability rates and lowering operations and maintenance (O&M) costs, according to Aalborg.

Spain sets out plan to double CSP capacity by 2025

Spain aims to double CSP capacity to 4.8 GW by 2025 and reach an installed capacity of 7.3 GW by 2030, according to a new 10 year energy plan set out by the government.

Under the plan, which will be reviewed by the European Commission (EC), Spain's installed PV capacity would hike from 8.4 GW in 2020 to 23.4 GW in 2025. Wind capacity would rise from 28.0 GW in 2020 to 40.3 GW in 2025.

Looming elections in Spain could disrupt the plan. Spanish Prime Minister Pedro Sanchez called a snap national election for April 28 after parliament voted down his latest budget bill.

The government's plan would reduce coal-fired capacity from 10.5 GW in 2020 to 4.5 GW in 2025 and reach close to zero by 2030. Gas-fired generation capacity would hold steady at 27.1 GW while nuclear capacity would remain at 7.4 GW until 2025 and drop to 3.2 GW by 2030.

Spain direct normal irradiance (DNI)

(Click image to enlarge)

Source: Solargis

CSP experts predict falling costs could drive fresh development activity in Europe in the 2020's and Spain represents the largest market potential.

Spain hosts 2.3 GW of CSP capacity, almost all of Europe’s installed CSP base. The plants were commissioned between 2008 and 2013, before activity was halted by the removal of state subsidies. Spanish companies continue to develop CSP technology and play a major role in international projects.

Strong solar resources, good availability of large flat land area and domestic CSP expertise all favor growth in Spain, experts say. Accelerated grid expansions and capacity market mechanisms are needed to support growth, they warn.

Other potential markets include the southerly countries of Portugal, Italy and Greece.

New Energy Update