Energy giant Engie completes its first CSP plant; PG&E woes impact CSP loan ratings

Our pick of the latest solar thermal news you need to know.

Related Articles

Engie starts commercial operations at South Africa CSP plant

Engie has started commercial operation at its 100 MW Kathu CSP plant in South Africa, the French group's first CSP plant, the company announced February 6.

The 12 billion-rand ($875 million) Kathu plant incorporates parabolic trough technology with 4.5 hours of molten salt thermal energy storage.

Engie holds a 48.5% share in the development consortium which includes South African investors SIOC Community Development Trust, Investec bank, Lereko Metier and the Public Investment Corporation.

Spain's Sener and Acciona were lead engineering procurement contractors (EPCs) for the project, located in a 450-hectare site in the Northern Cape province.

Construction began in May 2016 following the signing of a 20-year power purchase agreement (PPA) with state utility Eskom.

A key challenge for the Kathu project was the hiring of workers from local communities to fulfil domestic content commitments.

Local content on the project was estimated at around 42.5%, Cedric Faye, CEO of Kathu Solar Park at Engie, told the Africa New Energy conference in March 2017.

The developer faced a number of unexpected demands from local business groups and implemented new contracts and training methods to ensure the project met its construction targets, Faye said.

South Africa's installed CSP capacity will rise to 600 MW when ACWA Power brings online its 100 MW Redstone CSP plant.

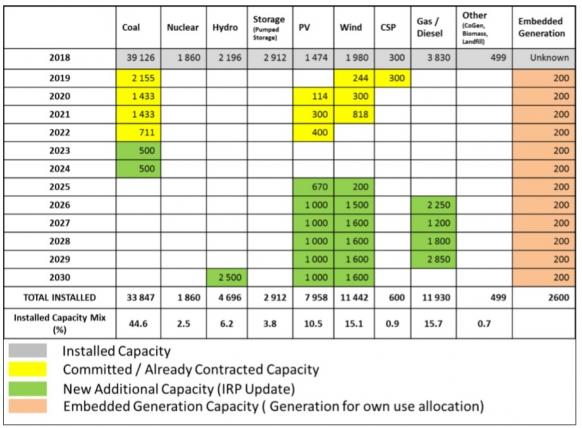

Last August, South Africa's government published a revised Integrated Resource Plan (IRP) 2010–2030 which included no explicit support for new CSP projects.

The draft IRP set out a least-cost approach to new independent power plants, and includes revised national assumptions on technology costs, power demand and the performance of power plants owned by state utility Eskom. The IRP ditches support for new nuclear plants in favor of PV, wind and hydro power capacity.

South Africa's draft generation build plan

(Click image to enlarge)

Source: South African government's draft Integrated Resource Plan (August 2018).

Engie's other assets in South Africa include the 94 MW Aurora windfarm, two PV solar parks of combined capacity 20 MW, and the 670 MW Avon and 335 MW Dedisa gas-fired peaking plants.

Engie also owns Thermaire Investments and Ampair, leaders in South Africa's heating, ventilation and air-conditioning (HVAC) market.

"Kathu with its molten salt storage design offers a clean solution to overcome the intermittency of renewable energies," Isabelle Kocher, CEO of Engie, said in a statement.

"We are proud to contribute to the country's renewable energy goals, and look forward to continuing the projects initiated with local communities making Kathu a genuine driver of regional economic development,” Kocher said.

Banks bail out California operator PG&E after Chapter 11 filing

California's Pacific Gas and Electric (PG&E) Company has been awarded access to $1.5 billion of bank financing to fund ongoing operations following its Chapter 11 bankruptcy filing, the company announced February 1.

PG&E filed for Chapter 11 bankruptcy protection on January 29 after several recent deadly wildfires left it with billions of dollars of potential liabilities.

The Chapter 11 filing has thrown into doubt numerous long-term renewable energy contracts held by the power utility.

PG&E is the sole offtaker of NextEra Energy's 250-MW Genesis Solar CSP parabolic trough plant, operational since April 2014. The project was built using a $852-million loan guarantee from the U.S. Department of Energy (DOE).

After PG&E announced it would file for bankruptcy protection, Fitch Ratings downgraded its long-term issuer default ratings of PG&E to C from BBB-, according to reports. Fitch then downgraded the credit rating of Genesis Solar's $140.4 million of series B trust certificates due 2038, from BBB- to C.

The potential removal of the plant’s power purchase agreement (PPA) with PG&E “would weaken the project's financial profile, and in a merchant scenario its cash flows would likely be inadequate to repay the debt,” Fitch said.

The agency affirmed the AAA and stable outlook on Genesis Solar's $561.6 million of series A trust certificates, which are guaranteed by the US federal government.

On February 1, the U.S. Bankruptcy Court for the Northern District of California granted PG&E interim approval to access up to $1.5 billion of its $5.5 billion in debtor-in-possession financing which will fund "essential maintenance and continued investments in safety and reliability," PG&E said.

"The Court's approval of these motions is a positive step forward that will enable PG&E to continue providing safe and reliable natural gas and electric service to our millions of customers," John Simon, PG&E's Interim CEO, said.

"In addition, with access to new financing, we have the necessary capital to continue investing in system safety and ensure essential maintenance as we move through this process," Simon said.

New Energy Update