ContourGlobal sells 49% stake in Spanish CSP plants; Africa’s AfDB agrees $212mn loan for Redstone CSP

Our pick of the latest solar thermal news you need to know.

Related Articles

ContourGlobal sells 49% stake in 250 MW Spanish CSP capacity

ContourGlobal has agreed to sell 49% of 250 MW of Spanish CSP assets to a fund advised by Credit Suisse Energy Infrastructure Partners (CSEIP), ContourGlobal announced December 6.

ContourGlobal purchased the five 50 MW assets from Spain's Acciona earlier this year. The plants are situated in south-west Spain and came online between 2009 and 2012.

The new buyer will pay 134 million euros ($152.8 million) for the 49% stake, almost double the net investment made by ContourGlobal, the company said.

Under the agreement, ContourGlobal will continue to manage, operate and maintain the assets, it said.

The transaction is expected to be completed by the end of June 2019.

"We are very pleased to expand our partnership with CSEIP in Europe with our second sale of minority interests this year," Joseph C. Brandt, President and Chief Executive Officer of ContourGlobal, said.

"CSEIP is a committed long-term partner and leading investor in the infrastructure field, combining deep industry expertise with unique sourcing and distribution capabilities," he said.

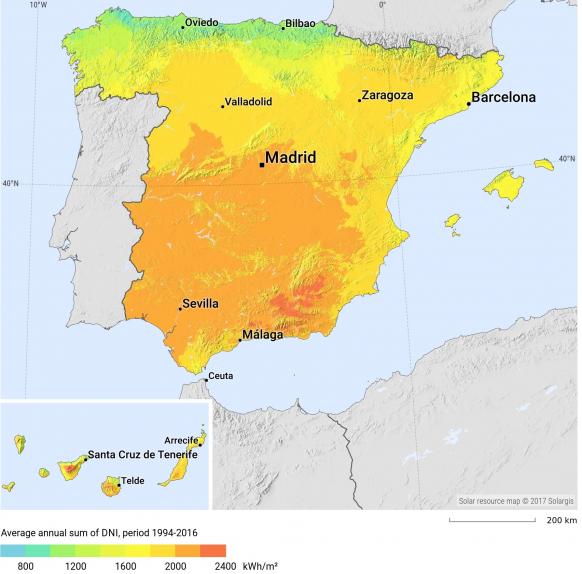

Spain has installed around 2 GW of CSP and 5 GW of PV capacity to date. Since 2012, new installations have slowed after the government introduced sales taxes and removed subsidies.

Last month, Spain's minority Socialist government set out a plan to build 3 GW of solar and wind capacity per year over the next decade and produce 35% of energy from renewable sources by 2030.

Spain direct normal irradiance (DNI)

(Click image to enlarge)

Source: Solargis

South Africa's Ilanga 1 plant starts commercial operations

The 100 MW Ilanga 1 parabolic trough plant in South Africa, owned by domestic group Karoshoek Solar One, has started commercial operations on schedule, EPC consortium partners Sener, Emvelo and Grupo Cobra, said in a joint statement December 5.

The Ilanga 1 project was awarded in 2015 in the third round of South Africa's Renewable Energy Independent Power Producers Procurement Program (REIPPPP). The plant incorporates five hours of molten salt thermal energy storage (TES) capacity.

“This is the first CSP plant in the history of the [REIPPPP] that was conceived and developed by a 100% black-owned South African entity," Pancho Ndebele, founder of Emvelo, said in the statement.

"We are particularly pleased that it was completed on time, within budget, within the required quality standards, in line with the contracted output performance and within acceptable safety standards," Siyabonga Mbanjwa, Regional Managing Director for Sener Southern Africa, said.

South Africa's installed CSP capacity was 300 MW at the end of 2017. Including Ilanga 1, 300 MW of projects are expected online by the end of 2019.

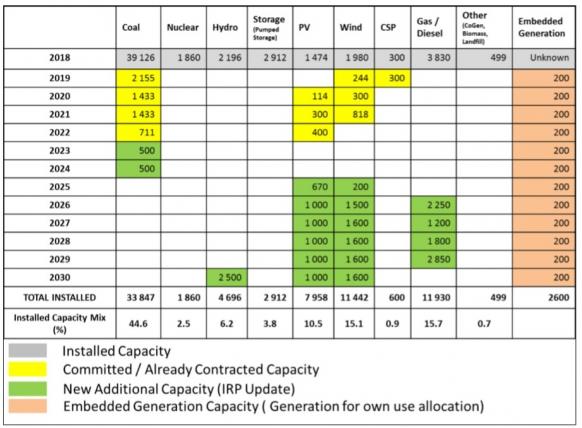

In August, South Africa's government published a draft Integrated Resource Plan (IRP) for 2010–2030 which includes no explicit support or targets for new CSP projects. The IRP sets out annual targets for PV and wind capacity and ditches support for new nuclear plants.

South Africa's draft power generation plan

(Click image to enlarge)

Source: South African government's draft Integrated Resource Plan (August 2018).

The IRP sets out a least-cost approach to new independent power plants and includes revised assumptions on technology costs, power demand and Eskom's power generation performance. The South African government has collected market feedback on the plan and is expected to make further announcements in the coming months.

African development bank agrees $212-million loan for Redstone CSP

The African development bank (AfDB) has approved a senior loan of 3 billion rand ($212 million) for ACWA Power's 100 MW Redstone CSP project in South Africa’s Northern Cape province, the bank said November 30. Minority stakeholders in the $798-million project include technology provider SolarReserve (10%) and South African groups PIC (13.5%), OMLACSA (10%), Community (12.5%) and Pele Green (4%).

The Redstone project was awarded in 2015 in the third round of South Africa's Renewable Energy Independent Power Producers Procurement Program (REIPPPP). The project was awarded at a tariff price of $124/MWh for a period of 20 years. The plant will incorporate 12 hours of molten salt thermal energy storage (TES) capacity.

The project will include the construction of a new 132 kV switching station, and a 34 km transmission line.

In April 2018, the South African government finally signed the power purchase agreements (PPAs) for Redstone and 26 other renewable energy projects, ending more than two years of delays due to state financing concerns.

In July, Saudi Arabia's ACWA Power and the Central Energy Fund of South Africa agreed to co-invest in Redstone as part of a new broader renewables investment alliance.

New Energy Update