China CSP entrants bolster IP licenses, services to secure growth

Western CSP companies operating in China must focus on robust intellectual property (IP) licenses and deeper supply and services bases to retain a share of the fastest-growing CSP market, industry experts told New Energy Update.

Related Articles

In October, China started commercial operations at the 50 MW Delingha CSP plant, the country’s first large-scale CSP plant. The plant is located in Qinghai province, north-western China, and uses SBP Sonne's parabolic trough and IDOM's molten salt storage technology.

Delingha is one of 20 projects selected for China's 1.35 GW CSP Commercial Demonstration Pilot Program which provides projects with feed in tariffs of RMB 1.15/kWh ($170/MWh).

The pilot program has made China the world's fastest growing CSP market and spurred an influx of Western CSP specialists through joint ventures with Chinese groups.

There are now around 28 CSP projects under development or construction in China, and around a third include Western companies, according to the latest data from the CSP Global Tracker. More Western companies are expected to join as many tenders are yet to be launched.

At the same time, CSP growth outside China has been dented by plummeting PV and wind prices and the removal of subsidies in key markets such as Spain.

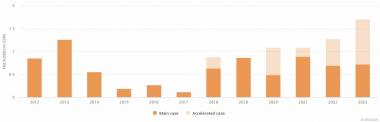

China is forecast to install 1.9 GW of new CSP plants by 2023, almost half of new global capacity, the International Energy Agency (IEA) said in a report in October.

Forecast global CSP installations

(Click image to enlarge)

Source: International Energy Agency (IEA), October 2018.

Chinese groups are also expanding CSP partnerships overseas. China’s Silk Road Fund acquired 49% of equity in ACWA Power’s 950 MW Noor Energy 1 CSP-PV in Dubai while Shanghai Electric was awarded the contract to install the plant.

China is also building CSP design standards and Western entrants must innovate to remain competitive after expertise is transferred in the first wave of projects, industry experts said.

Joint projects

Western CSP developers have held more of a technology and engineering role in China, rather than lead project development. Western engineering procurement contractor (EPC) groups, suppliers and advisory firms have also been hired to provide specialist expertise and parts.

In April 2016, U.S. CSP technology group 247Solar signed a Joint Venture (JV) agreement with Shenzhen Enesoon Science and Technology Co. to develop 1 GW of CSP capacity using its modular 247Solar plant design.

The partnership with Enesoon has since ended and 247Solar has signed a replacement agreement with another counterparty, Bruce Anderson, CEO of 247Solar told New Energy Update. Anderson would not name the counterparty.

Through the deal, 247Solar licenses its technology to the JV, providing exclusive rights to manufacture and sell 247Solar components in China.

Manufacturing gains from the modular 247Solar design should allow the developer to maximize China's supply chain efficiencies. 247Solar estimates the cost of building 1 GW of capacity in China at $3 to $4 billion.

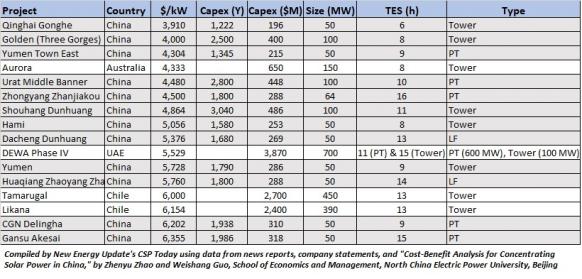

Capex of CSP projects confirmed in 2016-2018

(Click image to enlarge)

Note: Table compiled by New Energy Update in April 2018. Since then, changes made to projects such as DEWA Phase IV (renamed Noor Energy 1), which is now a hybrid 950 MW CSP-PV project.

Enesoon chose 247Solar technology based on cost and its ability to be "built quickly and operated simply," Zhiyong Zeng, Enesoon CEO, said in 2016.

“Quick installation means lower capex and quicker time to revenue,” Anderson noted. “Ease of operation means lower opex.”

International companies must move fast to gain the best business arrangement in China, Anderson said.

China is still in "learning mode" on CSP development, as they have been in other technologies in the past, he said.

"They won’t always be. So, Westerners need now to get their best deal on their IP," Anderson said.

US influence

Boosted by international trade programs, U.S. CSP groups have dominated Western developer presence in China.

The 247Solar-Enesoon JV was sponsored by the US-China EcoPartnership Program which supports partnerships of experts and innovators from US and Chinese institutions. In 2009, the two countries launched the US-China Renewable Energy Partnership (USCREP) to develop a roadmaps for renewable energy.

In 2014, California-based CSP tower developer BrightSource Energy signed a JV with Shanghai Electric to build utility-scale CSP plants in China.

Planned projects include six tower plants of capacity 135 MW under the Huanghe Qinqhau Delingha project.

The BrightSource-Shanghai Electric JV has already impacted projects outside of China.

Shanghai Electric will install a 150 MW BrightSource CSP tower plant as part of ACWA Power's giant Noor Energy 1 project in Dubai, which also includes a 600 MW parabolic trough plant.

The JV in China has helped improve the efficiency of the BrightSource tower design for Noor Energy 1 and lowered supply chain costs, Wang Deyuan, Associate Managing Director - Integrity Energy Solution Business Unit at Shanghai Electric, said at a conference in April 2018.

Shanghai Electric worked with BrightSource to optimize the installation of central tower solar fields, including mirrors, molten salt receivers, and control systems, and these learnings can be applied to the Dubai project, Deyuan said.

For the parabolic trough section of the Noor Energy 1 project, Shanghai Electric is collaborating with Spanish technology supplier Abengoa to find innovative solutions to best integrate the solar field and power block, he said.

Maximizing overall plant performance is a priority for Shanghai Electric.

"We will mix best practice from the past experience...And continue to optimize the solutions. We found there are a lot of spaces to be improved,” Deyuan said.

China standards

Other suppliers involved in Chinese CSP projects include Danish steam generator supplier Aalborg, German HTF supplier Wacker Chemical, U.S. valve and pump supplier Flowserve, German collector, receiver tube and turbine supplier Siemens, Belgian central receiver supplier CMI and Italian receiver tube supplier Archimede Solar.

Flowserve is to supply most of the critical molten salt valves for the 100 MW Shouhang Dunhuang tower project. The U.S. group is also helping China to develop new design standards.

In August, China announced it would develop the world’s first design standards for CSP tower plants. The new standards will include the "latest design concepts, requirements and technical level" for solar tower plants and they will play an important “guiding role”

in China's first batch of CSP plants, China Energy Engineering Corporation (CEEC) said.

“Flowserve is actively working with NWEPDI (part of CEEC) in developing technical guidelines for critical molten salt valve installations in solar tower plants," Angel Cantarero, Flowserve’s Global CSP Manager, told New Energy Update.

"These technical standards are expected to show up in future CSP project designs in China," he said.

Future business

Early development partnerships have allowed western companies to access the Chinese market but market competition will toughen as China moves beyond its first wave of CSP projects.

As Chinese groups continue to collect learnings from Western CSP specialists, some local partners will start to become competitors.

Developers must be careful not to damage wider business potential through exclusive IP contracts with Chinese counterparties, Anderson said.

Fair bilateral IP and licensing arrangements will also ensure China continues to attract international expertise to help build its nascent CSP market, he noted.

"An almost iron-clad IP licensing agreement is required," he said.

To ensure long-term success, western suppliers must be prepared to invest in wider sales and service facilities in China, as well as manufacturing bases, Cantarero said.

Flowserve’s manufacturing facility in Suzhou, opened in 2007, services the oil and gas, power, chemical processing and energy sectors.

“It is essential to leverage both production and service capabilities in China,” Cantarero said.

By Kerry Chamberlain