Vestas suspends 2020 outlook due to COVID-19; Spanish factories worst hit

Our pick of the latest wind power news you need to know.

Related Articles

Vestas suspends 2020 guidance due to coronavirus disruption

Vestas, the leading global turbine supplier, has suspended its financial outlook for 2020 due to ongoing coronavirus (COVID-19) disruptions, the Danish company said April 7.

Vestas had predicted revenues of 14 to 15 billion euros ($15.2-16.3 million) in 2020 and planned to invest 700 million euros.

Factory closures and travel restrictions have impacted Vestas' manufacturing, supply chain and installation activities, the company said. In Europe, Vestas has closed its generator factory in Viviero, Spain and is running its blade factory in Daimiel, Spain at minimum capacity, according to industry association WindEurope.

"Unfortunately, the pandemic continues to spread and with no clear prognosis on when key wind markets such as the USA, Brazil and India will recover, we are suspending our guidance due to the poor visibility for the remainder of the year," Henrik Andersen, Vestas President and CEO, said in a statement.

Vestas' preliminary figures for the first quarter are in line with expectations and the company could still meet its 2020 financial targets, it said.

Vestas factories in China have returned to normal operation and the company will use this capacity where possible to mitigate challenges in other parts of the world where disruption is increasing, the company said.

Europe wind factory closures confined to Spain, Italy

Europe's wind power factories are continuing to operate amid the COVID-19 pandemic except in Spain, where 15 manufacturing sites were closed, and Italy, where three factories were shuttered, industry group WindEurope reported.

Some other factories temporarily paused activity to strengthen sanitary measures, WindEurope said. The supply of Chinese materials and components was ramping back up after factory shutdowns in February, it noted.

Spain and Italy have been battling to reduce coronavirus cases after recording the world's highest death tolls. On March 28, Spain tightened nationwide coronavirus restrictions, prohibiting all "non-essential" work, including renewable energy installation, for two weeks. Many experts predict European nations will require lockdowns of varying severity for months.

Siemens Gamesa Renewable Energy’s blade factories in Aoiz and Somozas, its nacelle factory in Agreda and gearbox production facilities in Asteasu, Burgos and Lerma. Vestas closed its generator factory in Viviero and its blade factory in Daimiel was running at minimum capacity, WindEurope said.

Nordex closed two nacelle factories in Valencia and Val d’Uixo and its blade factory in Lumbier while GE Renewable Energy subsidiary LM Wind Power closed two blade factories in Castellon and Leon. Offshore wind shipbuilder Astilleros Gondan stopped production in Figueras.

In Italy, eTa closed its blade factory in Fano, Celme stopped production of transformers in Montebello Vicentino and Promau shuttered its cylinders and cones facility in Cesena.

Strong wind, low demand cut Spanish power prices

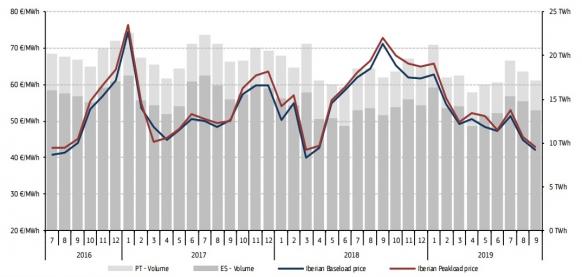

Strong wind resources and lower demand due to COVID-19 lockdowns increased the share of wind power in Spain in March, pushing power prices to their lowest level for four years, data from grid operator Red Electrica and market operator OMIE showed.

Wind power output was 5,543 GWh, some 15% higher than in March 2019. This increased the share of wind power to 28% of national demand and lowered average wholesale prices to 27.7 euros/MWh.

Historic power prices in Iberia (Spain, Portugal)

Source: European Commission's Quarterly Electricity Market Report

France postpones onshore wind tender

France has partially postponed its July onshore wind tender due to the coronavirus pandemic, extending the bid deadline for 500 MW of the 750 MW capacity until November 1, the energy and environment ministry said April 1. For the remaining 250 MW, the deadline of July 1 is maintained, it said.

Construction deadlines for onshore wind projects will also be postponed, the government said. A fixed extension for project deadlines will be announced once the length of the lockdown period is known, it said.

In its latest tender round, France allocated 749 MW of onshore wind projects at an average price of 62.9 euros/MWh ($68.0/MWh).

Germany has already loosened construction deadlines for onshore wind projects to account for coronavirus delays.

For the moment, the dates of future renewable energy tenders in Germany will remain unchanged, energy regulator Bundesnetzagentur (BNetzA) said March 23.

Germany plans to tender 900 MW of onshore wind capacity June 1, followed by 300 MW in July, 400 MW in September, 900 MW in October and 400 MW in December.

Spain installed 2.3 GW of onshore wind in 2019, the highest in Europe. While the lockdowns have impacted Spain's wind supply chain and construction industries, most of the projects now underway in Spain are not subject to strict completion deadlines, AEE, the Spanish wind industry association, said.

In addition to supply chain disruption, coronavirus restrictions are delaying some administrative procedures, AEE noted.

Vattenfall pulls out of offshore tender due to coronavirus

Swedish utility Vattenfall will not participate in the ongoing Dutch Hollandse Kust Noord offshore wind tender due to market uncertainty caused by the coronavirus pandemic, according to media reports.

Vattenfall won the last two Dutch offshore wind tenders in 2018 and 2019. The group will build the 350 MW Hollandse Kust I and II and 760 MW Hollandse Kust 3 and 4 projects at unsubsidized prices.

“There is too much uncertainty right now to make this kind of investment decision,” spokesman Robert Portier told Reuters April 2.

“We have seen demand for energy decline, as many stores are closed and industrial production is down, and we don’t know how long this will persist. We also don’t know what the market will look like after all this is over,” he said.

The Netherlands aims to increase offshore wind capacity from 1 GW in 2019 to over 4.5 GW by 2023.

Orsted retains 2020 financial outlook despite pandemic

Denmark's Orsted, the world's largest offshore wind developer, has maintained its financial outlook for 2020 despite global travel restrictions due to the coronavirus pandemic.

Orsted predicts EBITDA of 15-16 billion Danish crowns ($2.2-2.3 billion) in 2020, down from 17.5 billion crowns in 2019 mainly due to lower earnings from offshore wind partnerships.

By end of 2020, Orsted will have an installed offshore wind capacity of 7.5 GW and the company plans to hit 15 GW by 2025.

Orsted's installed asset base remains fully operational at "normal availability rates" and construction projects are progressing according to plan, CEO Henrik Poulsen said in a COVID-19 update March 25.

"There is a risk that key suppliers get delayed and that our own personnel are constrained by the travel restrictions put in place in many countries, but so far we have been able to find solutions to the challenges," he said.

Orsted's hedging programs have limited the impact of lower gas and power prices and the majority of its power offtakers are strong investment-grade entities, Poulsen said.

"This will support our resilience during the macro economic downturn which we must expect," he said.

New Energy Update