US wind repowering growth hinges on fresh turbine, operations gains

U.S. tax credits have accelerated wind repowering activity but investments in 2020-2025 will depend on improvements to turbine upgrade packages, industry experts said.

Related Articles

Earlier this month, Leeward Renewable Energy and turbine supplier GE completed the repowering of Leeward’s combined 136 MW Sweetwater 1 & 2 wind farms in Texas.

U.S. wind operators face continuing wholesale price pressure in the coming years and the federal government’s extension of the 10-year Production Tax Credit (PTC) scheme until 2019 has boosted interest in repowering projects.

The Sweetwater 1 & 2 wind farms were repowered after 14 and 12 years of operations, respectively. The repowering included the replacement of major turbine system components and installation of the latest operating technology to increase plant efficiency.

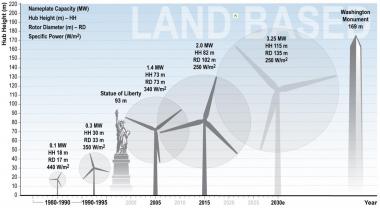

Rising turbine capacities are helping operators maximize gains from new wind projects and shifting the economics of repowering existing sites. Average wind fleet ages are rising, incurring higher maintenance costs. The average turbine age in North America will rise from 5.5 years in 2015 to 7 years in 2020 and 11 years in 2025, according to the 2017 IHS Markit Wind O&M Benchmarking in North America report, published last month.

The increase in rotor diameter provided by repowering projects offers the greatest benefits in performance gains, Andrew Flanagan, senior vice president of development at Leeward, told New Energy Update.

Further gains are created by higher generator capacity while new improvements in plant design allow existing towers to handle the larger, more powerful equipment, he said.

Forecast US turbine capacity, hub height

(Click image to enlarge)

Source: Berkeley Lab Survey (2016).

Back in 2013, the National Renewable Energy Laboratory (NREL) forecast that the U.S. repowering market would be worth $25 billion between 2015 and 2030. However, this assumed that 25% of plants repower after 20 years of operations, 50% after 25 years and the remaining 25% either continue operating unchanged or are decommissioned. Since this forecast, turbine innovations, cost reductions and PTC incentives have prompted operators to examine repowering far earlier in the life-cycle.

Companies planning to repower U.S. projects over the next two years include NextEra Energy and Leeward Renewable Energy, both in Texas; Rocky Mountain Power, mainly in Wyoming; and Infigen in Illinois. Oil group BP has also launched a repowering project for its U.S. wind power fleet.

Tax power

The PTC extension provides 10 years of tax credits at $23/MWh for greenfield and turbine upgrade projects started in 2016. The PTC drops by 20% for projects started in 2017 and is scaled down by 20% annually with zero support from 2020.

Since the PTC scheme was extended in 2015, operators have sped up their repowering programs to take advantage of the credits, Eric Lantz, an analyst at NREL, told New Energy Update.

The PTC extension is likely the "principal driver" of recent repowering investments, Lantz said. Without the PTC incentive, many of these repowering decisions may have been taken in the early to mid-2020s, as investors waited until around 20 years of operations, he said.

Lantz does not expect the rate of repowering to continue at the same pace between 2020 and 2025, after the PTC scheme has expired.

“I don't expect the rate of technology improvement to offset the lost value of the PTC quite that quickly,” Lantz said.

Repowering activity could regain momentum thereafter, depending on the rate of technology gains, he said.

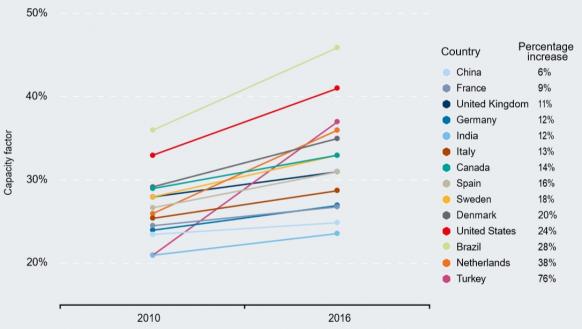

Growth in onshore wind capacity factors by country

(Click image to enlarge)

Source: International Renewable Energy Agency's Renewable Cost Database.

Cost benefits

Advances in turbine technology are underpinning large capital investments in repowering projects.

Rocky Mountain Power is planning to invest $1 billion in upgrading its existing wind projects, mainly in Wyoming, with larger blades, better control systems and technology. The operator predicts the repowering project will provide an 11 to 35% increase in power production levels.

The project forms part of Rocky Mountain's Energy Vision 2020 program and the company has calculated the PTCs allocated under the repowering between 2020 and 2030 will cover the entire cost of the repowering. The operator submitted its plans for regulatory review in June 2017.

In another example, GE has said the repowering of 706 MidAmerican Energy turbines in Iowa will generate 19 to 28% more power.

Costs of full repowering include the installation of larger turbines, upgraded gearboxes, hub, main shaft and main bearing assemblies and advanced latest monitoring technology. Benefits include higher output, lower operational costs and extension of project life.

By increasing generating capacity at existing projects, operators can avoid some of the permitting and administrative costs of developing new sites. In addition, the operator has already gained experience and data on the site conditions.

However, repowering projects may require the renegotiation of power purchase and interconnection agreements. The risk of installing larger turbines on existing towers and foundations must also be fully analyzed.

According to Lantz, operators without access to tax credits might opt for partial repowering strategies, such as power electronics upgrades, controls upgrades, or rotor upgrades that could yield an "incremental" energy production benefit with less capital outlay.

Upgrade options

Amid aggressive competition in the wind power market, turbine suppliers are offering a widening range of repowering options.

Original equipment manufacturers (OEMs) like GE are now offering repowering packages that include upgrades to turbine, gearbox and other main equipment, as well as options for operations and maintenance (O&M), grid solutions, forecasting and financing.

As well as providing the turbine unit for Leeward's Sweetwater 1 & 2 repowering project, GE also provides O&M services as well as tax equity financing through the GE Energy Financial Services arm.

"Repowering is so much more than simply providing new wind turbine equipment," Anne McEntee, GE Renewable Energy Vice President and Services CEO, said in May 2017.

"We’re bringing the entirety of GE to the table for our customers, providing options for servicing, grid solutions, forecasting and tailored financing solutions,” she said.

By Neil Ford