Orsted, Equinor win New York offshore projects; AEP submits 1.5 GW Oklahoma wind plan

Our pick of the latest wind power news you need to know.

Related Articles

Orsted, Equinor win New York offshore wind projects

New York has awarded 1.7 GW of offshore wind capacity to two separate projects led by Denmark's Orsted and Norway's Equinor.

The New York State Energy Research and Development Authority (NYSERDA) selected the 880 MW Sunrise Wind project, a 50-50 partnership between Orsted and New England energy supplier Eversource, and Equinor's 816 MW Empire Wind project, to enter into negotiations for a 25-year offshore wind renewable energy certificate (OREC), NYSERDA announced July 18. Both projects are expected online in 2024.

Sunrise Wind will be located 30 miles east of Montauk Point, Long Island, adjacent to Orsted and Eversource's South Fork and Revolution Wind projects. Orsted is currently developing 2.9 GW of U.S. East Coast offshore wind capacity and holds concessions for a further 5 GW of capacity, as well as 2 GW of potential capacity in Virginia.

Empire Wind will be located 15 miles south-east of Long Island and will be Equinor's first offshore wind project outside of Europe.

The 1.7 GW capacity allocation is the largest offshore wind procurement by a U.S. state to date. Last month, New Jersey selected Orsted's 1.1 GW Ocean Wind project to be the state's first large-scale wind farm.

New York Governor Andrew Cuomo also signed a new law on July 18 which requires the state to source 70% of energy from renewable sources by 2030 and achieve a carbon-free power system by 2040. The law includes a target of 9 GW of offshore wind by 2035, along with 6 GW of solar power and 3 GW of energy storage. Since March 2018, New York has awarded 4.7 GW of large-scale renewable energy contracts.

Infrastructure buildout

The Sunrise and Empire offshore wind projects include commitments to invest in manufacturing and port infrastructure in New York, on top of commitments by Governor Cuomo's government.

"A total of $287 million will be invested in cutting-edge infrastructure in multiple regions of the state, including the Capital Region, Brooklyn, Staten Island and Long Island," NYSERDA said.

"These financial commitments will unlock private supply chain capital and maximize the long-term economic benefits to the state from the regional development of offshore wind,” it said.

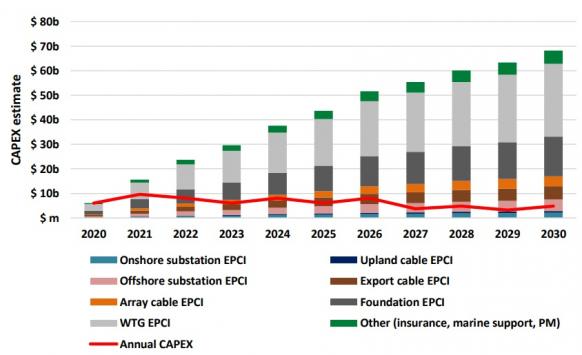

Value of US offshore wind supply chain

(Click image to enlarge)

Source: University of Delaware's Special Initiative on Offshore Wind, March 2019.

Orsted and Eversource plan to leverage procurement, construction and operational synergies for Sunrise wind from their South Fork and Revolution wind projects. In total, the partners plan to build 1.7 GW of capacity in the Northeast region in 2022-2024. The Sunrise, South Fork and Revolution projects will all use 8 MW Siemens Gamesa turbines. Construction of South Fork is scheduled to start in 2021 with commercial start-up in 2022.

Orsted and Eversource have also committed to build an offshore wind operations and maintenance (O&M) hub in Port Jefferson, Long Island, by investing in additional port infrastructure and establishing offshore wind training programs.

Equinor will invest over $60 million in port upgrades in New York and commit over $4.5 million to workforce development and community benefit schemes, the company said.

"Empire Wind is expected to have significant infrastructure and supply chain opportunities at the Port of Coeymans in the Capital Region and South Brooklyn," it noted.

Vattenfall to build second subsidy-free offshore wind farm in Netherlands

Sweden's Vattenfall is to build its second unsubsidized offshore wind farm in the Netherlands after winning the 760 MW Hollandse Kust I and II project tender.

In March 2018, Vattenfall was awarded the 350 MW Hollandse Kust I and II project at a zero-subsidy price. A year earlier, Denmark’s Orsted and Germany’s ENBW had become the first offshore wind power developers to acquire concessions at unsubsidized prices, bidding prices of zero euros per MWh to win projects in German waters.

For the Hollandse Kust projects, the transmission cable will be installed by Dutch grid operator Tennet. Vattenfall will pay around 2 million euros ($2.3 million) per year in ground rent for the Hollandse Kust (zuid) III and IV site, the Dutch government said in a statement.

Netherlands offshore wind capacity is forecast to rise from 1 GW in 2019 to over 4.5 GW by 2023, representing 16% of national power generation.

Denmark's Orsted is currently building the Borssele I and II wind farms and the Blauwind consortium, consisting of Royal Dutch Shell, Eneco and Mitsubishi, is building Borssele III and IV. Vattenfall is preparing to start construction of Hollandse Kust I and II.

AEP seeks to buy 1.5 GW of new wind projects in Oklahoma

American Electric Power (AEP) has sought regulatory approval for the purchase of 1.5 GW of wind power projects Invenergy is building in Oklahoma, in a slimmed down version of AEP's failed Wind Catcher proposal.

The projects include a 999 MW project north of Weatherford and a 287 MW wind farm southwest of Enid, both due online in 2021, and a 199-MW facility south of Alva, due online in 2020. Under the proposal, AEP subsidiaries Southwestern Electric Power Co. (SWEPCO) and Public Service Co. of Oklahoma (PSO) would acquire 810 MW and 675 MW, respectively.

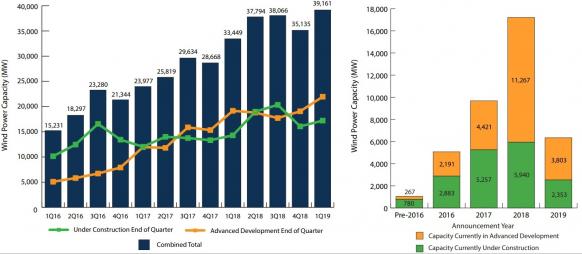

US wind capacity in advanced development

(Click image to enlarge)

Source: AWEA, April 2019.

Last August, AEP cancelled its Wind Catcher project to build a 2 GW windfarm in Oklahoma and 350-mile transmission line in the U.S. Interior, after the Public Utility Commission of Texas (PUC) denied approval.

Wind Catcher involved the development of the U.S.'s largest wind farm in the Oklahoma Panhandle and construction of a transmission line to send the power to eastern Oklahoma. The project also proposed to serve customers in Texas, Louisiana and Arkansas.

The Texas PUC said the project did not provide enough benefits for ratepayers. Oklahoma authorities had already questioned the benefit to consumers and were yet to make a final decision. The project had gained approval from federal, Louisiana and Arkansas authorities.

AEP had required timely approvals from regulators in order to complete the project by end of 2020 and be eligible for 100% of the federal production tax credit (PTC), the company said last year.

Under AEP's latest proposal, 1.3 GW of the 1.5 GW of capacity would receive 80% PTC, with the remainder at 100% PTC.

The projects will require regulatory approval in Arkansas, Louisiana, Oklahoma and Texas, as well as from the Federal Energy Regulatory Commission (FERC).

EDF-Masdar completes financing on 400 MW Saudi wind farm

A consortium led by EDF Renewables and Masdar has reached financial closure on the 400 MW Dumat Al Jandal utility-scale wind project, Saudi Arabia's first large-scale wind farm and the largest wind facility in the Middle East, the companies announced July 22.

The $500 million Dumat Al Jandal project will be located in the Al Jouf region, 560 miles (896km) north of Riyadh and is due online in Q1 2022.

Saudi Arabia awarded the project to the EDF-Masdar consortium in January at a price of $21.3/MWh. This price is paid through a 20-year power purchase agreement (PPA) with the Saudi Power Procurement Company, a subsidiary of Saudi Electricity Company (SEC).

The project financing includes Saudi and international banks, the partners said.

Vestas is the contracted wind-turbine technology provider and engineering, procurement and construction (EPC) supplier. TSK will be responsible for the balance of plant (BOP), while CG Holdings will provide the substations and high-voltage solutions.

New Energy Update