MidAmerican connects market forecasts with analytics to boost wind output

MidAmerican Energy Company is combining analytics systems with new weather and grid forecasting tools to increase the value of its growing wind portfolio in the competitive power markets, project partners said during a New Energy Update webinar on September 27.

Related Articles

For over a year, MidAmerican has been working with Uptake, a fast-growing predictive analytics supplier, to integrate software that will increase asset reliability and minimize operations and maintenance (O&M) costs.

By the end of 2017, MidAmerican will operate 4.3 GW of wind capacity across 23 wind farms in Iowa, Mark Jeratowski, Maintenance Manager at MidAmerican, told the webinar audience.

Wind power accounted for 55% of energy sold to MidAmerican’s Iowa retail customers in 2016 and new wind assets and repowering work will see this share rise to around 95% by 2021, he said.

Many wind operators are now using predictive analytics products to optimize maintenance activities and analytics suppliers are expanding system capabilities to tackle the upcoming challenges faced by wind owners.

The gradual removal of tax credits for new wind farms and expiry of credits for older turbines will expose more plants to wholesale market prices. In order to minimize costs, wind fleet operators must shape their O&M strategies around wholesale market drivers, as well as system performance.

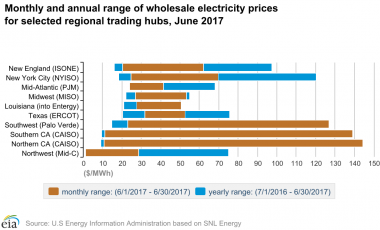

U.S. wholesale price ranges by market

(Click image to enlarge)

MidAmerican, a Berkshire Hathaway Energy (BHE) subsidiary, is building on its new analytics capabilities by developing new tools that respond to a range of wholesale market drivers and increase competitiveness against other generation types.

Weather forecasts may drive prices in some markets while other markets may be more sensitive to grid congestion.

"We are doing a lot of analysis right now in tool development to be able to improve the weather forecasting at a site, as well as recognizing what patterns of behaviour are happening on the grid to help not just with the market scheduling of power, but also the capacity scheduling requirement," Mike Kelly, a Consultant at Ensemble Energy Services who has been working with Uptake on the project, told the webinar audience.

By combining weather and load forecasting with predictive maintenance insights, operators can optimize scheduled maintenance and parts replacement and gain greater control of wholesale revenues, Kelly said.

"If you can schedule [maintenance] around what you know is coming in the way of weather and market pricing, that will enable you to maximize your uptime when you want it," he said.

Fast feedback

Predictive analytics platforms allow users to input data from multiple sources to generate insights on system performance and provide preventative actions to reduce downtimes.

Systems are incorporating machine learning so that once an operators' objectives and datasets are placed within the platform, the system can use a growing network of industry data to continuously improve accuracy and provide more sophisticated insights.

Uptake has thus far installed its technology at around 700 MW of MidAmerican's wind capacity and expects to complete installation across the entire fleet by April 2018.

"Everything we are seeing points to uncovering a lot of value," Sonny Garg, Global Energy Lead at Uptake, told the webinar.

"Within two days we found we had predictive insight on a main bearing failure that had it gone catastrophic, would have [cost] about $250,000, but because we are able to find it and send somebody up turbine, we could fix it before it happened at $5,000," he said.

In another example, one of MidAmerican's turbines had been operating at around 18% below expected efficiency for the last three years, Garg said.

Proactive maintenance on key components like main bearings will help MidAmerican to reduce the need for emergency repairs and should have a significant impact on inventory costs, Jeratowski said.

"We don't have the exact figures for that yet but we are looking forward to a major reduction in inventory," he said.

New findings

In just three years, Uptake has expanded into multiple industry sectors, including mining, oil and gas, rail, aviation, construction and manufacturing.

In the wind sector, the company is developing new functionalities which will increase the sophistication of the system and allow operators to respond to a range of market conditions.

The developer is preparing to roll out a "downtime editor and analytics" tool which will allow operators to better understand loss factors, Garg said.

"The way we categorize loss factors may be really generic and there may be opportunities to better understand those and understand the patterns to drive availability, without necessarily focusing on the component parts of the turbine itself," he said.

Faults on relatively inexpensive components can impact the quality of loss data. In one example, analytics on the power curve discovered a broken anemometer which was impacting data quality.

"If you weren't looking at the data you wouldn't even know that...Once you start looking at the data you find anomalies, you find things in the data that don't make sense," Garg said.

By the middle of 2018, Uptake plans to integrate market condition analytics to their software to maximize revenue relative to wholesale markets.

"By bringing in more data with regards to the markets or data with regards to weather you begin to be able to find ways to optimize your bidding strategy regardless of the market you are operating in," Garg said.

Uptake also plans to integrate inventory functionality to optimize spare parts strategies by late 2018, he said.

In addition to O&M gains, the developers at Uptake expect their systems to increasingly inform design decisions and end-of-life strategies.

Growing networks

U.S. wind operators must also prepare for new initiatives set to enhance the resilience and reliability of the electricity grid. Increased communication capabilities could open up new income streams for developers.

A grid reliability report published by the DOE in August recommended the implementation of pricing mechanisms which value Essential Reliability Services (ERS) and Bulk Power System (BPS) resilience. The DOE would research new technology which helps renewable energy plants provide ERS and support BPS resilience, it said.

On September 29, the Trump administration showed its support for coal and nuclear power plants as part of a diversified generation mix, by proposing new market rules which recover the costs of generation assets which provide grid reliability services and have a 90-day fuel supply on site to mitigate against supply disruptions.

As power grids integrate an increasing range of asset technologies and sizes, growing analytics capabilities will help generators and grid operators connect different sources of energy production, Ryan Blitstein, Director of Renewable Energy at Uptake, told the webinar audience.

"The more these things are connected in a way that is intelligent and via a single platform, the more value could be added for a larger number of players in that world," he said.

New Energy Update