GE goes beyond carbon neutral to cut blade waste

GE Renewable Energy is set to become carbon neutral this year and is working on improved turbine blade recycling and alternative materials to increase productivity and reduce waste, Danielle Merfeld, the company's Chief Technology Officer, told New Energy Update.

Related Articles

As climate concerns grow, the full environmental impact of wind power deployment is under increasing scrutiny. For developers and suppliers, carbon neutrality is becoming a priority.

On January 30, leading offshore wind developer Orsted said it aims to become carbon neutral by 2025. Orsted would also engage with suppliers to achieve a carbon neutral supply chain by 2040, it said.

GE Renewable Energy plans to become carbon neutral by the end of this year, the company announced in September. GE will reduce emissions through operational efficiencies, securing renewable energy supply for all of its wind, hydropower, energy storage and grid businesses, and by purchasing carbon offsets, it said.

GE blade subsidiary LM Windpower already became carbon neutral in 2018, after the group switched to renewable energy supply and acquired carbon offsets.

GE is now working to develop alternative materials, technologies and processes that will eliminate waste, increase productivity and recycle products at end of life, Merfeld told New Energy Update.

Recycling of component materials will be key to reducing the wind sector's carbon footprint and new blade materials will be required. Around 80-90% of nacelle equipment can be recycled at end of life but a recyclable blade is yet to be developed.

The wind industry is now tackling this issue, Merfeld said.

"The next generation of blades will be designed to consider recycling from the outset,” she said.

Slicing waste

Currently, turbine blades are typically made out of composite materials that are sent to landfill when decommissioned, Charlotte Stamper, energy spokeswoman at Zero Waste Scotland, told New Energy Update.

“Future assets should be designed for full reuse of materials and for components to easily be replaced and refurbished," Stamper said.

Potential recycling solutions include co-processing using a ‘cement kiln’, where the fibers are used as an alternative to coal and raw materials used in the production of cement, Christopher Springham, head of global communications and sustainability at LM Wind Power, said.

“Co-processing with a cement kiln is indeed among the most promising technologies for composite waste from wind turbine blades....The next step is scaling this and other solutions so they are accessible on a global level, which is something we are looking at from a cross-industry perspective," he said.

In another method, the blades could be mechanically reduced to sub-components or flakes and reused as construction material or in other industrial applications, Springham said.

Alternatively, individual materials can be chemically separated and reused, he said.

A shift from full ownership of major components to leasing models could also cut emissions, Stamper said.

Leasing models allow operators to return components when no longer needed. These components could be reused by others, either as they are, or enhanced with new technologies.

Cost incentive

Carbon reduction initiatives can help wind suppliers improve competitiveness. Intense price competition has dented suppliers margins and prompted companies to seek efficiency gains along the whole life-cycle of the product.

Lower cost is “one of the strong motivations for us to pursue carbon neutrality for our operations so aggressively,” Merfeld said.

Fuel, logistics, waste disposal and travel all “have cost associated with them,” she noted.

Falling renewable energy costs means switching to carbon-free power can reduce suppliers' costs.

Indeed, LM Wind Power achieved carbon-neutrality primarily by switching to renewable energy supplies, both through long-term power purchase agreements (PPAs) and installing onsite wind and solar assets at factories.

LM Windpower also invested in LED lights, ventilation control and energy management systems to reduce electricity usage.

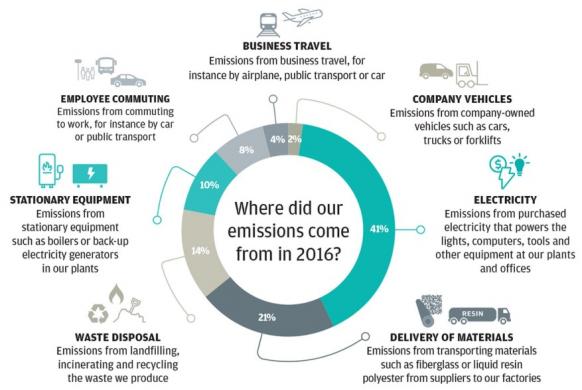

"At 41% of emissions in 2016, we soon realized that electricity usage across our company was the first area we needed to take on," the company said.

Source of LM Windpower's carbon emissions in 2016

(Click image to enlarge)

Source: LM Windpower

By reprocessing, reusing or reconditioning components, owners can create end-of-life value, Stamper noted.

Logistics breakthroughs

Transportation and installation methods will also need to evolve to shrink the carbon footprint of onshore and offshore projects, Merfeld said.

As developers seek larger, higher efficiency turbines, greater design modularity will help to reduce transport and installation challenges, she said.

Last year, GE Renewable Energy signed the first commercial contract for its new two-piece 5.3 MW onshore turbine blade with German developer Prowind.

Unveiled in 2018, the 77-meter carbon blade provides higher energy output than smaller blades and is assembled on site, reducing transport risks and improving site accessibility.

Separately, U.S. group Keystone Tower Systems is currently testing on-site spiral welding processes for taller turbine towers that remove transport constraints.

More progressive blade structures and transport methods could further transform turbine development, offering greater logistics, installation and operational efficiency.

U.S. researchers are currently assessing five alternative blade designs that could allow 5 MW land-based turbines with rotor diameters of 206 m, some 50 m longer than GE's latest model.

Offshore impact

Offshore project partners must also develop new ways to cut carbon emissions from installation and decommissioning.

Zero Waste Scotland has worked with subsea technology group Ecosse IP to develop an integrated floating wind deployment solution which is transported by small towing vessels. The solution avoids the use of heavy-lift vessels in installation and decommissioning.

"The system can be used to lift, lower or hover any subsea object, by controlling buoyancy and ballast in low pressure pipes," Stamper said.

More can also be done in operations and maintenance (O&M). In the offshore wind sector, the use of electric or hydrogen boats and greater sharing of resources with oil and gas operators could reduce the carbon footprint, Stamper said.

Learnings from the oil and gas sector will help the offshore wind industry decarbonize.

“We already see synergies from oil majors entering the offshore wind space," Merfeld said.

"There’s existing infrastructure to leverage and capabilities in operating offshore," she said.

Less obvious partnerships with other industries will also have an impact.

"Everyone will scrutinize their supply chains for ways to either eliminate waste, or offer it as a resource,” Merfeld said.

Reporting by Beatrice Bedeschi

Editing by Robin Sayles