Falling offshore prices reveal UK supply chain, grid build savings

Plummeting UK offshore wind prices show developers are combining technology advancements and installation experience with innovative grid build modelling, industry experts told New Energy Update.

Related Articles

Last month the UK government awarded 15-year contracts for difference (CFDs) to three new UK offshore wind projects at prices as low as 57.50 pounds per MWh ($78.1/MWh).

Dong Energy was awarded a contract at 57.50 pounds/MWh for its 1.4 GW Hornsea Project Two off England's north-east coast, which will become the world's largest offshore wind farm. EDPR and Engie were awarded a CFD at the same price for their 950 MW Moray Offshore Windfarm (East) project in Scotland. Innogy and Statkraft were allocated a contract at a price of 74.50 pounds/MWh for their 860 MW Triton Knoll offshore project off England's east coast. The three new projects are due to start electricity production from 2022-2023.

The contract prices were around half the price of contracts awarded in the last UK offshore wind tender in February 2015, showing how economies of scale, growing installation experience and technology advancements are driving down costs.

The bids were not as low as prices paid in other recent European offshore tenders, as UK developers are required to take on additional project risks in site development and transmission grid construction. However, the UK prices were far lower than most expected and show that developers are finding innovative ways to weave grid build risks into lower-cost project structures.

Samuel Leupold, Executive Vice President and CEO of Wind Power at Dong Energy, said the UK tender prices demonstrate the "cost saving potential of developer-built offshore grid connections.”

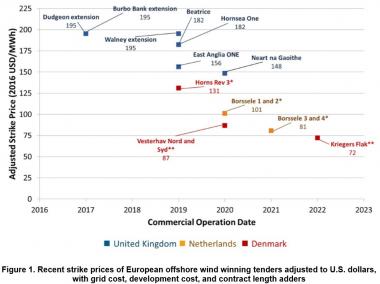

European offshore tender prices in US $

(Click image to enlarge)

Source: U.S. National Renewable Energy Laboratory (NREL). Data source: 4Coffshore.

UK transmission grid costs were estimated at around $1 million/MW in 2016, according to Bloomberg New Energy Finance (BNEF). Average capex for European offshore wind projects was estimated at $4 million/MW.

Innogy used its experience in generator-lead transmission system construction and offshore supply chain learnings to reduce transmission risks and costs for its Triton Knoll project, Richard Sandford, Innogy's Director of Offshore Investment & Asset Management, told New Energy Update.

“We’ve explored a dynamic rating system to optimize the export system and achieve more megawatts through the network. We’ve been able to design out elements of the infrastructure thanks to advanced power flow modelling; and we’ve minimized infrastructure at both our onshore and offshore substations," he said.

The Triton Knoll partners worked hard to reduce all costs associated with project delivery to lower the levelized cost of energy [LCOE], Sandford said.

“A combination of our own experience and innovation, the increasing efficiency and maturing of technologies, together with collaborative working with our key suppliers, means we are now robustly challenging costs across the board,” he said.

Indeed, the sharp drop in prices signals that the UK may be reducing offshore wind costs faster than other European nations. The incorporation of transmission costs into competitive tenders should benefit UK consumers in the long run, Richard Aukland, Director of Research, at analysis group 4C Offshore, told New Energy Update.

“The UK bids are higher [than European prices] in terms of the auction price paid, but they are probably not higher if you look at the net cost to the tax-payer,” he said.

As new UK project concessions are issued further offshore, transmission costs will represent a growing share of project costs, incentivising further cost reductions.

Big business

A key driver of cost reductions in onshore and offshore wind has been the development of larger, higher efficiency turbines, requiring less resources per MW for installation and operations.

Commissioning dates are set many years in the future, allowing developers to factor in higher turbine capacities than currently available.

Earlier this year, Dong Energy was the first developer to use 8 MW turbines on its Burbo Bank Extension wind farm off the coast of Liverpool and the developer has predicted turbines of capacity 13 to 15 MW will be on the market by 2024.

Innogy and Statkraft plan to install 9.5 MW MHI Vestas turbines for their Triton Knoll project, the partners said September 18.

Rising project sizes are also significantly reducing costs through economies of scale and series.

This has been a key strategy for Dong Energy, which plans to change its name to Orsted. The leading global offshore developer by capacity, Dong Energy aims to double its installed wind capacity from 3 GW in 2016 to 6.5 GW by 2020, rising to 11 GW-12 GW by 2025.

"We have always promoted size as a key driver for cost. The ideal size of an offshore wind farm is 800 to 1,500 MW,” Leopold said last month.

“There are definitely cost savings including those from supply chain efficiencies, greater purchasing power and O&M savings, as projects get bigger,” Giles Hundleby, a Director at consultancy firm BVG Associates, told New Energy Update.

Local knowledge

The UK has been a frontrunner in offshore wind development and developers are now benefiting from the maturing of the market for equipment and services.

Installed offshore capacity by country

Source: WindEurope (January 2017).

“We’ve got a really good supply chain now around these sites. They’ve got bases and skilled labor and products and services that they can then move out to the developing fleet and that has cost saving implications,” Emma Pinchbeck, Executive Director at RenewableUK industry group, said.

Dong Energy noted Hornsea 2 would benefit from a growing and competitive supply chain and the use of the company's new operations and maintenance (O&M) hub at Grimsby, UK, which also serves other Dong Energy offshore wind farms on the UK east coast.

Developers are also acquiring adjacent sites to benefit from the clustering of resources and leverage earlier project learnings.

“They’ve got the opportunity to expand their supplier’s pipelines…their increased scale increases their bargaining power with the suppliers and they benefit from economies of scale in the supply chain," Hundleby said.

This is demonstrated by Dong Energy's adjacent Hornsea Projects. Construction experience on Hornsea 1 has reduced the construction and operation risk for Hornsea 2.

“From a bidding point of view, Dong obviously has a very good understanding of the site conditions at Hornsea 2…so they will have a good understanding of any risks and reflect that in their contingency plans,” Hundleby said.

Project experience has aided the development of technologies suited to local conditions, Pinchbeck noted.

“They are using suction bucket foundations in some cases and they’ve improved the monopiles. They’re more efficient,” she said.

As the industry matures further, market participants expect to see higher capacity cables and O&M improvements.

Long-term wholesale price assumptions also play a key role in offshore project bids as higher market prices offer greater value after the fixed price contracts have expired. Dong Energy has estimated the operational lifetime of Hornsea 2 at 25 years which would expose the project to market prices for 10 years beyond the fixed price contract.

Disruptive technologies and changing consumption trends have complicated long-term power price outlooks and offshore wind developers must maximize the lifespans of turbines and continue to reduce O&M costs to ensure projects remain competitive.

By David Appleyard