Enel uses mix of turbine upgrades in Kansas to maximize returns

Enel Green Power is implementing a targeted repowering of drivetrains and blades at Smoky Hills to boost performance and secure maximum tax credits, Massimiliano Tarantino, Head of Repowering and Refurbishment at the company, told the Wind Operations Europe 2020 conference.

Related Articles

US demand for wind repowering has surged as operators seek to use turbine advancements and tax credits to increase revenue from ageing fleets.

Larger, higher efficiency turbines are increasing output and reducing operations and maintenance (O&M) costs. The phasing out of the 10-year US federal production tax credit (PTC) has spurred developers to build site-specific business cases for mid-life repowering. The PTC is set at $23/MWh for projects completed by 2020, then falls by 20% per year.

In Kansas, Enel Green Power (Enel) has launched a $114 million repowering project at its 149 MW Smoky Hills 1 and 2 wind farms in Ellsworth and Lincoln counties, operated under its subsidiary Tradewind Energy.

The repowering of Smoky Hills will increase annual output by 6.2% and extend the lifespan from 2028 to 2040, Tarantino told the conference in Munich on March 6.

The project will also receive 100% PTCs for 10 years, through a mix of component repowering and replacement, he said.

Operators can use repowering gains to mitigate growing wholesale market risks. As long-term power purchase agreements (PPAs) expire and wind operators are exposed to wholesale prices, they face increasing competition from falling solar prices.

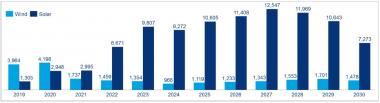

Wind, solar corporate demand (aggressive forecast)

(Click image to enlarge)

Wood Mackenzie report 'Analysis of commercial and industrial [C&I] wind energy demand in the U.S,' August 2019.

At Smoky Hills, existing long-term PPAs covering 76% of output will provide prices above wholesale market levels for the first eight years of repowered operations, Tarantino said.

"After the PPA expires, 100% of the production will be sold merchant," he said.

Bespoke approach

Enel installed 1.8 GW of global wind capacity in 2019 and 1.2 GW of solar, raising its total installed renewable energy capacity to 46 GW.

Wind repowering decisions must be made on a case-by-case basis as significant capex is required and site-specific factors can influence costs, Tarantino told attendees. Key benefits include increased project life, higher output, lower O&M costs and tax benefits.

To qualify for PTC credits, Enel will repower 15 drivetrains at Smoky Hills and repower blades with longer models.

Online since 2009, Smoky Hills consists of 99 GE Renewable Energy 1.5sle turbines. For 49 of these, GE will replace blades of rotor diameter 77 meter with 91 m versions, and replace gearboxes, main shafts, hub blades and refurbish generators.

For the remaining turbines, Siemens Gamesa will replace the gearbox and the main shaft.

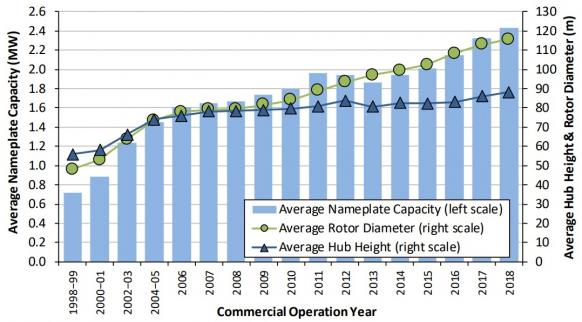

Average US wind turbine nameplate capacity, dimensions

(Click image to enlarge)

Source: Department of Energy's 2018 wind technologies market report, National Renewable Energy Laboratory (NREL).

"This mix of reblading, refurbishment and changing the nacelles with the power train is the techno-economical trade-off between the expected return on investment and the financial rules that will allow us to renew the production tax credit components," Tarantino said.

"We kept the same foundations and the same towers... This helped us to reduce costs," he said.

Repowering can increase annual energy output by up to a quarter, but site-specific factors often favor partial repowering, providing significant efficiency improvements at lower cost.

Projects installed between 2003 and 2010, underperforming plants and those with high maintenance costs are all likely candidates for partial repowering, ICF consultancy said in a 2018 report.

Maintenance gains

Critically, the new turbines at Smoky Hills will reduce O&M costs by $7,000/MW/yr, Tarantino said.

Falling capex costs and intense wholesale market competition have raised the importance of wind O&M.

Larger, higher efficiency turbines reduce the cost of maintenance per MW and operators can install the latest analytics solutions in repowering projects to increase operational efficiency.

Turbine suppliers predict further advances in technology could support repowering demand after the PTC phases out. Key areas of focus include maximizing uptower capabilities and predictive maintenance gains.

For future models, suppliers are developing "crane less" operations and turbine automation that will further boost performance.

Robin Sayles