Oil group Galp becomes Spanish solar giant; Qatar signs PV contract below $16/MWh

Our pick of the latest solar news you need to know.

Related Articles

Oil group Galp to buy 2.9 GW of Spanish PV projects

Portuguese oil and gas group Galp Energia has agreed to buy stakes in 2.9 GW of Spanish PV capacity, in operation or under development, from ACS Group, Galp announced January 22.

Valued at 2.2 billion-euro ($2.4 billion), the portfolio includes 900 MW of operational capacity and 2 GW of projects scheduled to be built by 2023, and will make Galp one of the largest solar operators in Spain.

The deal is expected to be closed in the second quarter of 2020, at which time Galp will make a payment of 450 million euros and assume 430 million euros of project finance liabilities for operational plants.

Galp plans to allocate 40% of investment in businesses that help to reduce carbon emissions. The group plans to finance the new solar plants through project finance and will look for partnership opportunities.

Falling solar technology costs and growing offtaker demand have reignited Spain's solar market. Spain was the largest solar market in Europe last year and is forecast to install 3.5-4 GW/year of new capacity in the next five years, according to industry group SolarPower Europe.

In December, power utility Iberdrola completed the construction of its 500 MW Nunez de Balboa solar plant in south-west Spain, Europe's largest solar facility, within a year.

Iberdrola plans to invest 8 billion euros in 3 GW of Spanish renewable energy projects, mostly solar PV, in 2018-2022.

US set to install 13.5 GW utility-scale PV in 2020, smashing records

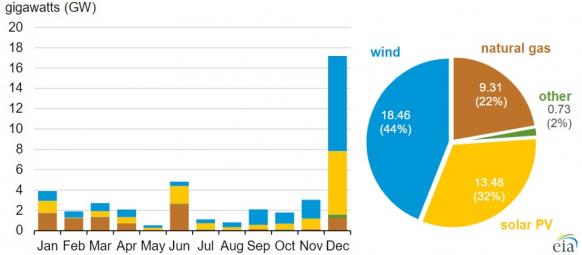

The U.S. is forecast to install 13.5 GW of utility-scale solar photovoltaic (PV) capacity in 2020, surpassing previous records and representing 32% of new power additions, according to the U.S. Energy Information Administration's (EIA) latest inventory of power generation projects.

The EIA's prediction is slightly higher than the 12.6 GW forecast by the Solar Energy Industry Association (SEIA) and Wood Mackenzie late last year. The previous record was 8 GW in 2016.

Wind installations will soar to 18.5 GW this year, also smashing records, EIA said. Wind will account for 44% of total new capacity additions, it said.

More than half of the new PV capacity will be in four states, EIA said. Texas is set to host 22% of new capacity in 2020, followed by California (15%), Florida (11%), and South Carolina (10%).

US planned power capacity additions in 2020

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA), January 2020

EIA predicts 9.3 GW of new gas-fired capacity will be brought online in 2020, while 11 GW of conventional power capacity will be shut down. Some 5.8 GW of coal-fired capacity will be closed, as well as 3.7 GW of gas-fired capacity and 1.6 GW of nuclear capacity.

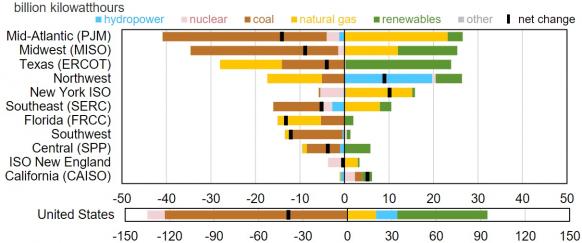

Forecast change in power generation by fuel in 2020

(Click image to enlarge)

Source: U.S. Energy Information Administration (EIA), Short-Term Energy Outlook, January 2020

EIA expects strong levels of solar and wind additions to continue into 2021. In addition, natural gas fuel costs will increase next year and gas-fired generation will drop by 2.3%, it said.

The U.S. contracted PV pipeline swelled to a record 38 GW in 2019 as falling costs spurred demand from utilities and corporate customers.

U.S. corporate demand for solar power is forecast to storm past wind power demand in 2021 and rise to ten times the demand for wind by 2024, Wood Mackenzie said in a report published in August.

The U.S. Midwest is set to be a key growth area for the solar industry in the coming years.

In the Midwest MISO, SPP, and PJM markets, some 6.6 GW of solar projects are “either under construction or in the latest stages of planning and likely to be completed through 2023," Fitch said in a research note in October. Around 79 GW of projects are in various stages of development in the region, it said.

Qatar signs PV price below $16/MWh on its first major project

The Qatar General Electricity and Water Corporation (KAHRAMAA) has signed a solar power purchase agreement (PPA) for the 800 MW Al-Kharsaah Solar PV Power Plant at a price of 5.71 Dhs/kWh ($15.7/MWh), one of the lowest ever recorded, KAHRAMAA said January 19.

The QAR 1.7 billion ($471 million) Al-Kharsaah project represents the first large-scale PV project in Qatar, following a competitive tender held in 2019.

The project will be 60%-owned by Siraj Energy, a joint venture of Qatar Petroleum (QP) and Qatar Electricity and Water Company (QEWC). Japan’s Marubeni Corporation and France’s Total Solar International will hold a 40% share.

The Al-Kharsaah plant will be brought online in phases, with the first 350 MW online by the first quarter of 2021 and the remaining capacity completed by the first quarter of 2022.

Heavily reliant on LNG imports, Qatar is looking to diversify away from fossil fuels. The capacity of the Al-Kharsaah plant will be equivalent to 10% of Qatar's peak electricity demand.

Qatar has already helped to advance global research in PV technology. The Qatar Environment and Energy Research Institute (QEERI) has performed pioneering research into module cleaning strategies, and more recently, bifacial module technologies.

Testing in Qatar's dry and desert -like conditions has generated learnings that that can be applied in multiple global markets.

QEERI has built significant datasets on key metrics such as PV electrical performance and temperature, irradiation, ground reflectance (albedo) and meteorological conditions.

Current research includes the impact of soiling on the rear side of bifacial modules, an area where industry knowledge is limited.

New Energy Update