Duke Energy deploys AI-drones over PV fleet to boost operating gains

U.S. utility Duke Energy is deploying AI-supported drones across its growing solar plant fleet in its latest push to raise self-operating efficiency, Jeff Wehner, Vice President of Operations, Renewables at Duke Energy, told the Solar PV Operations USA 2018 conference.

Related Articles

Facing intense power market competition, solar fleet operators are increasingly turning to drone technology to minimize operations and maintenance (O&M) costs.

The replacement of ground-based asset inspections with aerial drone imaging cuts inspection times and operators are now combining drones with artificial intelligence (AI) to provide automated maintenance insights.

U.S. utility Duke Energy owns and operates 600 MW of PV capacity and 2.4 GW of wind and has conducted drone inspections since 2015. The company is now deploying drones supported by machine learning AI across its U.S. solar plant fleet, Wehner told the conference on November 8.

Drone inspection data is downloaded into an AI system architecture which produces a detailed report of actionable insights, module by module, Wehner said.

"What we found is utilizing artificial intelligence, we could take the technician review out of that process," he said.

In August, Enel Green Power North America (EGPNA) announced a new partnership with AI developer Raptor Maps to deploy an integrated AI-drone solution which performs plant inspection and data analysis mid-flight, allowing faster fault correction.

EGPNA operates 4.3 GW of solar, wind, hydropower and geothermal capacity in North America. The company has started AI-drone field trials and plans to integrate drone inspections, SCADA data and predictive analytics into plant management systems later this year.

Larger fleet operators can gain the most from rapidly advancing analytics capabilities and Duke Energy clearly sees significant value in drone deployment. By the end of 2018, the utility plans to double the number of staff trained to use drones to 60 employees.

"We haven't flown over all of our [solar] assets yet but we hope to have that done by the end of the year," Wehner said.

In-house ops

Duke Energy is helping to drive solar growth in the U.S. Southeast, particularly in North Carolina where it is the dominant power supplier.

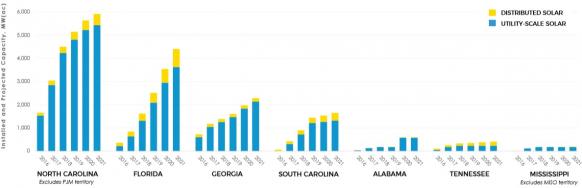

North Carolina installed 2.7 GW of solar power capacity in 2017, of which 83% was supplied by Duke Energy, the Southern Alliance for Clean Energy (SACE) group said in a report. Annual solar installations in North Carolina are expected to rise to over 6 GW by 2021, it said.

Forecast Southeast solar installations

(Click image to enlarge)

Source: Southern Alliance for Clean Energy (SACE).

Duke Energy’s solar fleet comprises of over 60 solar facilities in 11 states, using components from seven different tracker, eight inverter and 19 module manufacturers.

Some 17 of these facilities operate with out of warranty equipment, including over 200 inverters, eight tracker systems and over 645,000 modules.

Duke Energy has chosen to self-operate its renewable assets rather than extend warranty periods or use third-party service providers.

Larger operators can optimize labor and equipment and obtain greater purchasing power for spare parts. Duke Energy operates a 24/7 Renewable Control Center and employs over 300 highly skilled wind and solar technicians, engineers, operators and support staff.

"Generally, because of the size of our fleet, the scale that we have for renewable energies more generally, we are better off doing the self-op model," Wehner said.

A key advantage of self-operating is more flexible sourcing of replacement parts.

Parts can often be sourced from third-party vendors at a significant saving but efficient procurement requires sufficient in-house technical expertise and detailed inventory analysis, Wehner warned.

"You really need to do an extensive review of those sub-component parts and which ones are critical to best manage your inventory," he said.

Larger fleet operators like Duke Energy are now using centralized storage facilities and regional logistics hubs to optimize spare parts replacement.

Duke Energy uses a module of its computerized maintenance management system (CMMS) to perform inventory validation and tracking for its U.S. fleet. This allows it to locate parts that can be transferred between sites.

Group effort

Duke Energy’s growing scale and expertise has allowed it to expand into the highly-competitive O&M services market. The company’s Renewable Services subsidiary now has long-term operator or O&M contracts in place for over 1.5 GW of third-party wind and solar facilities.

These projects have helped Duke learn from challenges faced by the wider solar industry, but Wehner warned that broader industry benchmarking of O&M costs is needed to maximize returns going forward.

As solar costs fall, O&M will play an increasing role in project competitiveness.

"I think there has been a dearth, quite frankly, of [O&M cost] benchmarking in the solar field," Wehner said.

"We need to get together as an industry and challenge ourselves to improve it," he said.

New Energy Update