Dubai set for 'aggressive pricing' on first CSP tower plant

Dubai's 200 MW CSP tender framework offers potential cost savings from engineering through to operations and new entrants from China could help lower prices, Inaki Perez, Solar Team Leader at Mott MacDonald, DEWA's Technical Advisor, said at the MENA New Energy 2017 conference.

Related Articles

In July, the Dubai Electricity and Water Authority (DEWA) will select the winner of the United Arab Emirates' first CSP tower tender. DEWA invited bids for a 200 MW tower plant with a minimum eight hours’ storage and the plant is expected online by 2021.

The tender represents the fourth development phase of the Mohammed bin Rashid Al Maktoum (MBR) Solar Park which will host 1 GW of solar capacity by 2020. By 2030, the Park will host 5 GW of solar power capacity, including 1 GW of CSP capacity, helping Dubai reach its target of 25% of energy from renewable sources.

DEWA received 30 Expressions of Interest for the CSP project, represented by 34 regional and global companies. Six consortia have been shortlisted for the Request for Proposal (RfP) phase and their bids are expected by June.

The six shortlisted parties are "credible and reputable" bidders and include all the main global CSP development firms, Perez told the conference in Dubai on April 26.

The bidding should see “aggressive pricing”, due to a strong tender framework, the high-profile of the project within the CSP industry and the current limited number of global CSP tenders, he said.

Dubai has targeted a cost of $80/MWh for the 200 MW CSP tower project but technology and efficiency gains in other countries have shown lower costs are possible. Dubai's record-low PV price of $29.9/MWh for the 800 MW MBR phase 2 project has demonstrated the potential for cost optimization under the MBR program.

The track record requirements in the CSP tender are not as stringent as in some other previous global tenders and this will allow a good balance between experienced CSP developers and newcomers to the industry, particularly those from China, Perez said.

"We are expecting to see a few Chinese players there which hopefully will also help with bringing the cost down," he said.

China plans to build 1.3 GW of CSP capacity by 2018, equivalent to one quarter of global installed capacity.

Design savings

The price of Dubai's first large-scale CSP plant will provide a key benchmark for other growing CSP markets in the Middle East.

Last month, Saudi Arabia's government said it plans to build 1 GW of CSP capacity by 2023. Saudi Arabia's National Renewable Energy Program (NREP) sets a target of 9.5 GW of renewable energy capacity by 2023, as the country looks to diversify away from hydrocarbon resources amid growing power demand.

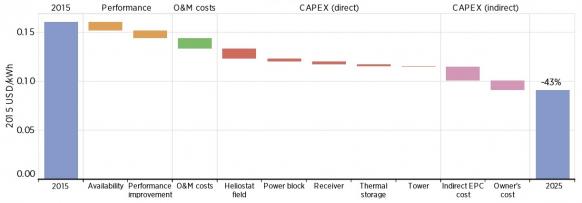

Innovative new heliostat designs and improved installation practices are helping to lower CSP tower costs. Competitive tenders are also putting pressure on supply margins as developers look to reduce the cost advantage of PV and wind plants.

CSP tower cost reduction potential by 2025

(Click image to enlarge)

Source: International Renewable Energy Agency's Power to Change report, 2016.

Dubai’s CSP tender has been designed to optimize costs along the life-cycle of the project, from the engineering phase through to operations.

DEWA has chosen to tender for two 100 MW towers as they represent a cost-effective solution at this stage of global CSP development, Perez said.

The configuration of two 100 MW towers “provides a good balance between economies of scale and a design that has been proven in previous projects-- it offers significant opportunities for cost savings compared to a single 100 MW tower," he said.

The tender specifications also provide design flexibility, allowing developers to optimize the solution within the tender requirements,” Perez said.

“It's not a very prescriptive bid in that sense," he said.

In addition, the tender criteria omits local content requirements, allowing a wider range of procurement options which will help to drive down costs.

Bidders are also entitled to submit an original alternative design proposal as long as it meets DEWA's offtake and cost requirements.

Site support

Dubai’s MBR solar park offers good port, road and airport links and there is good availability of skilled construction labor at relatively low costs, Perez told the conference.

In addition, there is a competitive local subcontractor market, he said.

Costs should also be optimized during the operations and maintenance (O&M) phase, as the plant will benefit from low-cost utility prices and access to the solar park's existing O&M staff, Perez noted.

"Compared to more remote places where projects are being developed at the moment, we think the access to O&M personnel will be easier," he said.

Competitive finance

Another key issue for CSP developers is the cost of finance. Dubai offers relatively low commercial and regulatory risk and DEWA will take a 51% stake in the project, improving the bankability of the successful bid.

The tender also sets out a relatively long 25-year power purchase agreement (PPA) with DEWA and this PPA arrangement has proved to be bankable in the previous phases of the solar park development.

Mott MacDonald believes there is healthy appetite from regional and international banks in the project and the strong balance sheets of the shortlisted bidders should further reduce costs, Perez said.

"All the shortlisted bidders have high financial standing and we are hoping that all this will help to [achieve] very low cost of finance," he said.

New Energy Update